It's just too bad there was no way to predict that Elon Musk would run a company this way! https://t.co/vEJaucR77o

— E.W. Niedermeyer (@Tweetermeyer) November 22, 2022

Tesla stock is now down 49% since Elon Musk offered to buy Twitter in April, losing over half a trillion dollars in market valuation.

— 🦀 Jon Schwarz 🦀 (@schwarz) November 21, 2022

Just in the three and a half weeks since Musk took over Twitter on October 28, Tesla stock is down 27%, losing $190 billion in value. pic.twitter.com/xoMQHQVbQV

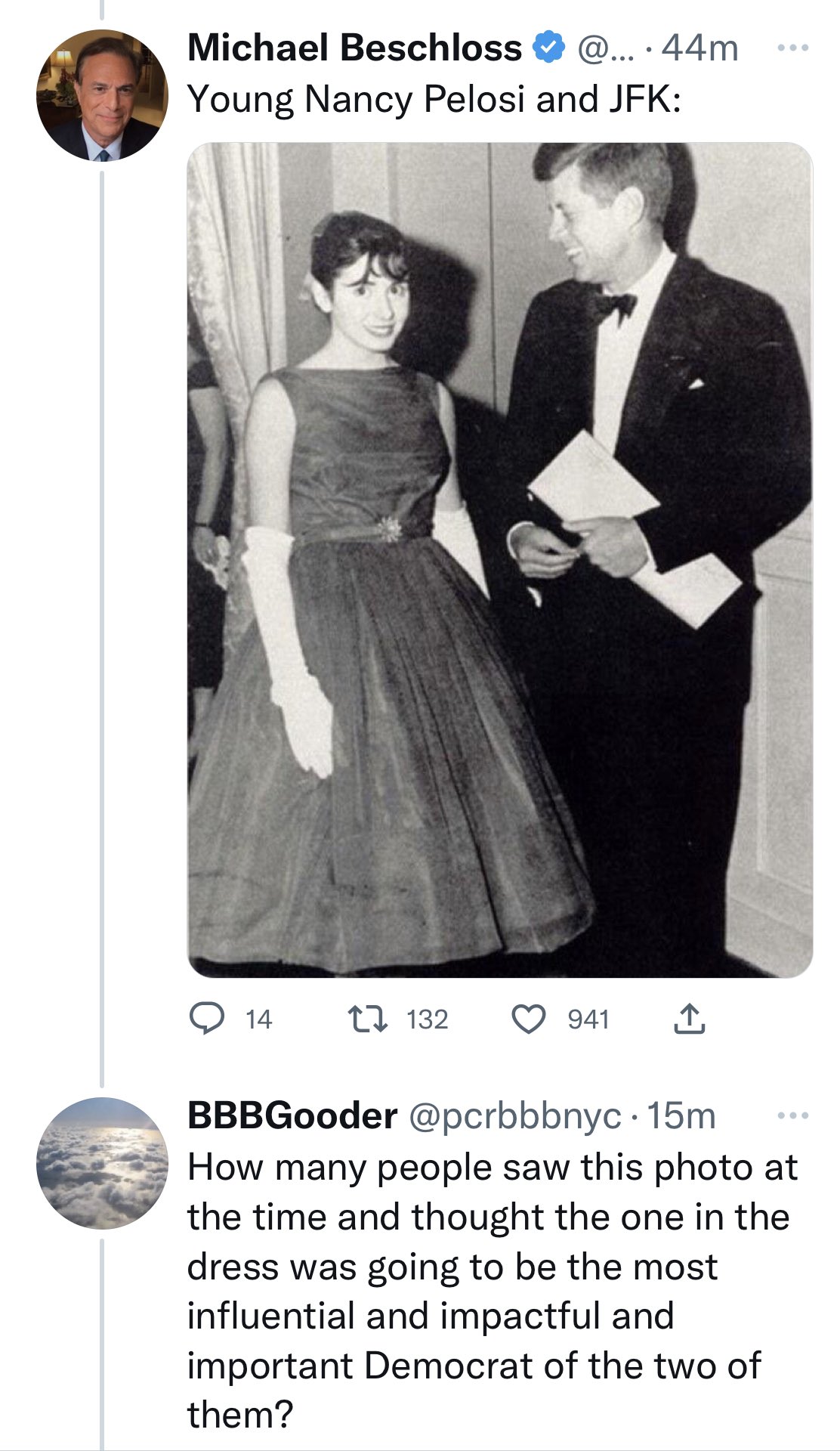

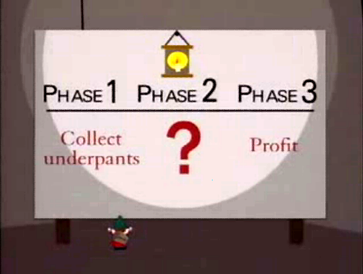

Some may be too young to get this but… pic.twitter.com/t6YdzJZlVN

— Jesus Chrysler (@JesusChrysler1) November 20, 2022

2/ of any social network is content moderation. That is an overriding fact. Second, the company has not developed a robust business model. It doesn’t have strong revenue streams, which in part goes back to the hellzone issues. These are the two core things that make it …

— Josh Marshall (@joshtpm) November 22, 2022

An advertiser explains why they’re pausing their Twitter ads campaigns: pic.twitter.com/jc0hBGzO4P

— Peter Yang (@petergyang) November 21, 2022

He has a lot of fine new friends though. Life is about trade-offs. https://t.co/h4i7Gd4tVK

— Ron Filipkowski 🇺🇦 (@RonFilipkowski) November 22, 2022

This is a tough lesson to learn, because "closer to the action" is such an easy heuristic for credibility. It happens all the time though... for example, the people closest to an addict are often the last people to see their addiction for what it is.

— E.W. Niedermeyer (@Tweetermeyer) November 22, 2022

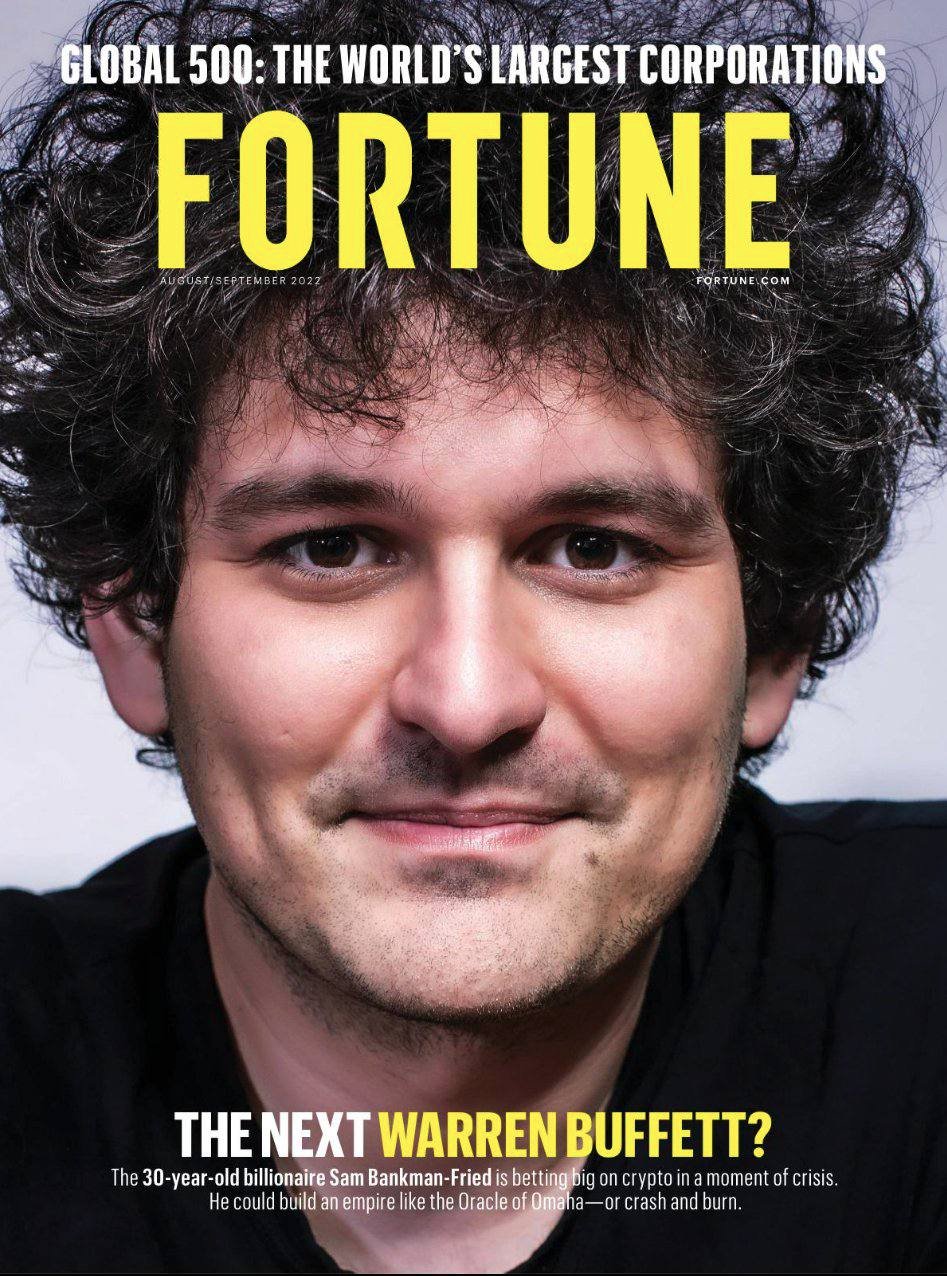

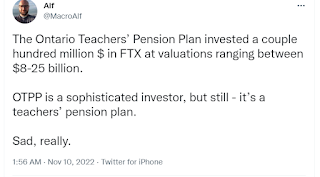

You know what would make this even better? A Sam Bankman Fried connection.

So, this is interesting...https://t.co/IhCX4SSutq

— CommonSenseSkeptic (@C_S_Skeptic) November 22, 2022

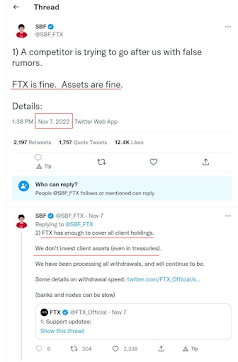

So he knew SBF was a fraud, but he wanted him to be a Twitter shareholder anyway? pic.twitter.com/IZjiiDETlw

— James Surowiecki (@JamesSurowiecki) November 22, 2022

Bumping this in light of today's news that Elon said he always knew SBF was a scammer but was secretly his business partner.

— E.W. Niedermeyer (@Tweetermeyer) November 22, 2022

He said the same thing about Liz... https://t.co/xXIIaz2T6c

So, after Elon claimed that SBF "set off his bullshit meter," and implied he'd corrupted the justice system through political donations, it turns out that they're actually partners in Twitter! The Aristocrats!https://t.co/OvMidxAwhg

— E.W. Niedermeyer (@Tweetermeyer) November 22, 2022

And let's throw in some creepy alt-right politics.

Notorious Finnish-German fraudster hiding out in New Zealand and fighting extradition to the US pumps great replacement theory, gets immediate high five from Mr Elon. pic.twitter.com/oNCDXUSesM

— Josh Marshall (@joshtpm) November 23, 2022

Where's Glenn? pic.twitter.com/M0DjJV4ypr

— Josh Marshall (@joshtpm) November 20, 2022

Politics

Turning from Twitter to Fox.

Congratulations to Joe Biden for solving crime in only two weeks since the midterms. https://t.co/hnjbnUxkF3

— The Hoarse Whisperer (@TheRealHoarse) November 22, 2022

Of course, the PM also believes in crypto...

Genuinely delusional. Completely detached from reality. “Now I voted for Brexit. I believe in Brexit and I know that Brexit can deliver, and is already delivering, enormous benefits and opportunities”https://t.co/cHSn5Pu892

— Shashank Joshi (@shashj) November 21, 2022

Excellent thread.

I want to engage this question earnestly, b/c it’s a legit question. The answer is yes, I do look at left, too.

— Caroline Orr Bueno, Ph.D (@RVAwonk) November 22, 2022

Left-wing activists are responsible for 2% of murders committed by political extremists in the US over the past decade; right-wing activists are responsible for 74%. https://t.co/eOzXog3vZT

And to less depressing politics

War and Revolution

#BREAKING: Iran national team players choose not to sing national anthem at World Cup match; some of the Iranian crowed booing their own national anthem pic.twitter.com/RYPvgHMNUi

— Amichai Stein (@AmichaiStein1) November 21, 2022

New on FX. The Swedes

Very retro. It's been a while since we saw an illegal couple. Last one was the US' Ghost Stories investigation in 2010? @gordoncorera https://t.co/L52ghcoLOH

— Shashank Joshi (@shashj) November 22, 2022

What an interesting artistic choice by Russia's London embassy to depict Ukraine's first Jewish president with that nose. https://t.co/Oo7R7Dbk2i

— Shashank Joshi (@shashj) November 22, 2022

The Fourth Estate is not up to the job

Start with this handy visual explainer.

Getting Team #ButHerEmails and the #BothSides Band back together for Access-Journalism-Hold-My-Beer Atrocity Week? @AshleyRParker @MaggieNYT @NanCook @KatieRogers #FixMediaNow https://t.co/AMG7JOJ34z pic.twitter.com/ZW6i0KcSBu

— Holley Atkinson 🆘 🇺🇸🇺🇦 mstdn.social/@HolleyA (@HolleyA) November 22, 2022

The press also needs to have perspective and provide context. What Ashley Parker’s tweet shows is that these are missing way too much. In effect it equates lies about Covid and elections with something that is utterly trivial. This is false equivalence that is truly dangerous. https://t.co/U0dBFmiKMx

— Norman Ornstein (@NormOrnstein) November 22, 2022

The phrase "stop digging" comes to mind ...

— James Fallows (@JamesFallows) November 22, 2022

MSNBC’s Ashley Parker Rightly DRAGGED for Ripping Biden’s Visits to Wilmington — Where His Wife and Children Are Buried

— Spring because after WINTER comes 🦁hear me ROAR (@summer7570) January 18, 2022

@MSNBC get rid of #fireAshleyParker https://t.co/iR7kPo5hpU

We'll close with pitchbot...

Whether it’s threatening the lives of reporters by targeting them as enemies of the state, or threatening the standing of reporters with their editors by not inviting them to a White House wedding, presidents on both sides have treated journalists unfairly.

— New York Times Pitchbot (@DougJBalloon) November 22, 2022

— Prof. Feynman (@ProfFeynman) November 20, 2022

Michael Collins, the astronaut who took this photo in 1969, is the only human, dead or alive, that isn't in the frame of this picture. pic.twitter.com/PA3GAhsLrP

— Jasmine 🌌🔭 (@astro_jaz) November 19, 2022