Over the years, I have followed how Mark follows the hype that many industries engage in, with ideas like the Ponzi threshold where over-valued companies end up making aggressive decisions to try and catch up with their value.

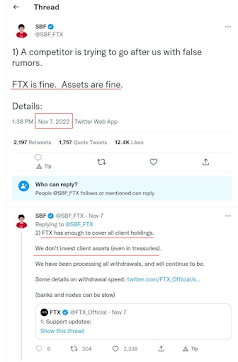

Consider the case of Sam Bankman-Fried (multi-billionaire at 30) and his new thread:

which ends with:

That said, there is an issue with crytocurrency having no underlying assets and the general issue of there being a reason that there are banking regulations. So let us consider an overvalued company, because of a very high acquisition cost.

It is not the best sign in the world that the CISO of Twitter has left in the first two weeks after the deal was concluded. Maybe not decisive, perhaps they have a different vision for the company, but not the best sign. But then you have things like this:

I have heard Alex Spiro (current head of Legal) say that Elon is willing to take on a huge amount of risk in relation to this company and its users, because “Elon puts rockets into space, he’s not afraid of the FTC.”The best reply was from Mike Dunford:

As legal arguments go, "Elon puts rockets into space," is creative. Novel. Even unique.For the non-lawyers: that's not a complement.

To be fair, we are in rather unique legal territory, as Mr Dunford later admitted, so perhaps a creative legal argument is needed because that is all that is left?

Furthermore, there is a crackdown on working from home:

Starting tomorrow (Thursday), everyone is required to be in the office for a minimum of 40 hours per week. Obviously, if you are physically unable to travel to an office or have a critical personal obligation, then your absence is understandable.

Now I am neutral on working from home. Sometimes it is a good thing because it can enhance productivity and sometimes it erodes team building or, under weak management, can be used for grift. But forcing people into the office rarely fixes a major problem and doing a major change in terms of employment on short notice is the sort of thing that induces morale problems when productivity is most important. After all, in the same letter Elon Musk notes:

Frankly, the economic picture ahead is dire, especially for a company like ours that is so dependent on advertising in a challenging economic climate. Moreover, 70% of our advertising is brand, rather than specific performance, which makes us doubly vulnerable!That is why the priority over the past ten days has been to develop and launch Twitter Blue Verified subscriptions (huge props to the team!). Without significant subscription revenue, there is a good chance Twitter will not survive the upcoming economic downturn. We need roughly half of our revenue to be subscription.

Yes, that is correct -- Twitter is redesigning its business model on short notice to change (almost completely) the revenue stream for the company. And the CISO just left.

Now, Musk may be an engineering genius [though there are other opinions -- MP], but this is no proof of being a successful businessman and the company that had his reputation is named after an authentic genius who died bankrupt. It is clear that Twitter is taking on non-trivial amounts of regulatory risk and needs to get a lot of subscribers fast (both at the same time). I am curious as to Mark's opinion on the likely outcome, as he is the expert in this type of corporate behavior, but it seems high risk to me.

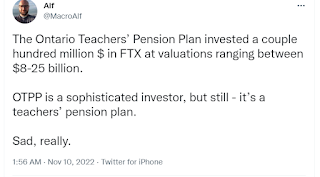

So hopefully these companies managed to avoid the Ponzi threshold, but I am dubious and I feel sad for their clients and the people who enjoyed their services.

No comments:

Post a Comment