From Matt Levine's newsletter (No, I don't have a link. It's a free newsletter. Why haven't you signed up yet?)

Meanwhile they were flailing around in private trying to figure out how they could make money. From the indictment:

On or about October 8, 2017, LOWE wrote FARNSWORTH and a team of MoviePass executives to ask them to brainstorm “ideas” about how to generate revenue: “So now that we have gotten into month 2 of our new pricing model we will need to create a plan on how we get from the usage level now to the desired profitable model in the future.”From the SEC complaint:

In March 2018, MoviePass hired a Chief Product Officer, whose main focus was to identify a break even business model and then explore how MoviePass could generate additional revenues outside of subscriptions. The Chief Product Officer quit less than six months later, after realizing that MoviePass’s business model would not work. The Chief Product Officer communicated his views to Lowe.

Keep in mind the new pricing model was basically selling dollar bills for 45 cents (specifically, on average "each customer paid MoviePass $9.95 per month, but cost MoviePass $22 per month in tickets."). You might think that the brainstorming stage might come before betting hundreds of millions on a business plan that sounded like an SNL parody of a bad start-up.

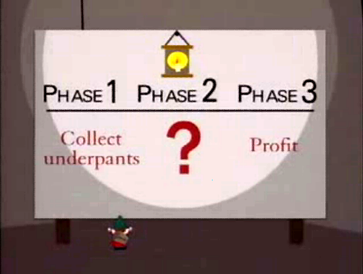

But while MoviePass is an extreme case, it is not extreme in an unrepresentative way. It takes the asset-bubble mindset of the teens to its logical conclusion. What set the company apart was less the absurdity and more the lack of pretense. Unicorns like Uber/Lyft and WeWork at least pretended to have thought about a path to profitability. All of their plans were essentially derived from a South Park episode. MoviePass just didn't bother to change the font.

No comments:

Post a Comment