What you'd expect to see if you prompted ChatGPT with the word nepo baby

Trump: "I think the people that have run CNN are a disgrace. I think it's imperative that CNN be sold because you certainly wouldn't want to just leave those people with some money so they can spend even more spending poison. It's lies. I wouldn't want to see the same company end up with CNN."

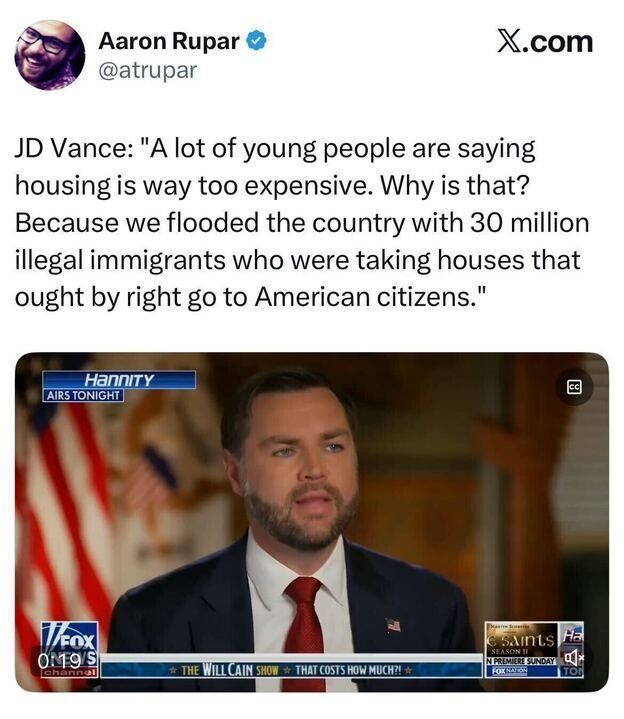

— Aaron Rupar (@atrupar.com) December 10, 2025 at 12:57 PM

[image or embed]

The saga continues. I live less than a mile from the gates of the Warner Brothers Studio. It makes this already strange story even more bizarre when you read about it sitting in a cafe patio then look up and see the actual WB water tower.

One of these days, I should probably do a post too about how disastrous mismanagement and ill-conceived financial deals put Warner Bros. in this position. It's a good story and one that has been largely untold by the big news organizations. If the studio had been competently run like, say, Columbia — which is in much better shape despite having fewer hits and a fraction of the IP — we would not be having this discussion.

Even a couple of years ago, the suggestion that Netflix buying WB would be the preferred outcome would have seemed absurd, but in 2023, we had no idea how bad an Ellison led Paramount would be, let alone the partners this new deal would involve..

From Josh Marshall:

Simply extraordinary stuff coming out this morning about the battle over what used to be Time Warner and now goes by the name Warner Bros Discovery (which includes CNN in addition to the more lucrative media stuff). The company had agreed to be acquired by Netflix. So Paramount — now the vehicle of the Ellison family successor and a Trump state media entity-in-the-making — has launched a hostile takeover effort to swoop in and gobble up WBD for itself. In its public pitch, it has openly advertised to shareholders that it is the better acquirer because the Ellisons are tight with Trump, and the White House will never let a Netflix deal go through. Trump, in comments yesterday, as much as agreed. Trump has refashioned antitrust oversight to be little more than a personal veto for the Trump family. Friends can do mergers; foes can’t. Indeed, the indifferent and uncommitted can’t either. You need to get right with the Trump family.

When you ask why so much of corporate America is beholden to Trump now, this is why. A big diversified corporation simply cannot compete and thus, in practice, can’t exist with a determinedly hostile administration.

Now we learn this: who else is part of the hostile takeover bid? None other than Jared Kushner. Yes, Jared — international M&A man when he’s not cutting “peace” deals in Israel-Palestine or Ukraine. And wait, there’s more! Just moments ago I saw that it’s not just Jared: the Saudis, Qataris and Emiratis are also in on the deal. Backstopping the deal is a fund, RedBird Capital, seen by many as a stalking horse for China.

At this point, perhaps our best hope is that events will lead to some events will lead to some belt-tightening around the Ellison household and the decision that they'll have to get by with only one studio.