The reason SBF is in prison is because he's not even half as smart as he thinks he is

— BuccoCapital Guy (@buccocapital) October 6, 2023

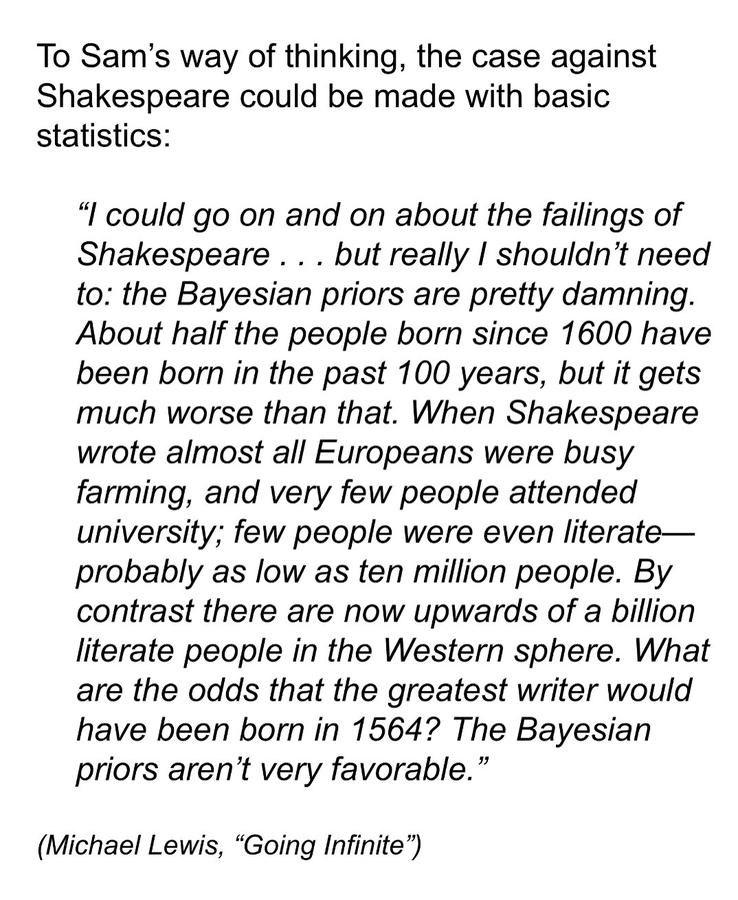

Exhibit 931: SBF on Shakespeare pic.twitter.com/SjYfZgULQd

Despite Musk's best efforts, there are still enough people on Twitter familiar with this classic example of a statistical fallacy to generate a suitable wave of mockery. Lots of tweets pointed out that any hand of poker, pat or not, would be evidence of cheating since the odds against getting any particular hand are astronomical. Others pointed out that you can't be your height (or other scenarios based on continuous variables.) according to this line of reasoning.

My go-to rebuttal of this broader class of fallacies is that any argument that can be applied equally well with minimal tweaking to every person living or dead cannot be informative. We are all highly unusual in some way.

P.G. Wodehouse once described his dim-witted hero Bertie Wooster as having passed through the world's finest educational institutions untouched by human thought. SBF came from one of the country's most distinguished academic families, grew up attending elite prep schools and math camps, graduated from MIT with a degree in physics and a minor in math, and still doesn't understand basic probability.

What's worse, this ineptness extends to the kind of mathematical reasoning that is at the very heart of Finance and particularly Trading. The indispensable Matt Levine points out this glaring example, also from Michael Lewis's book.

People have thought about this question! Like, this is very much a central thing that traders and trading firms worry about. The standard starting point is the Kelly criterion, which computes a maximum bet size based on your edge and the size of your bankroll. Given the intern’s bankroll of $100, I think Kelly would tell you to put at most $10 on this bet, depending on what exactly you mean by “this bet.” [7] Betting $98 is too much.

I am being imprecise, and for various reasons you might not expect the interns to stick to Kelly in this situation. But when I read about interns lining up to lose their entire bankroll on bets with 1% edge, I think, “huh, that’s aggressive, what are they teaching those interns?” (I suppose the $100 daily loss limit is the real lesson about position sizing: The interns who wipe out today get to come back and play again tomorrow.)

But I also think about a Twitter argument that Bankman-Fried had with Matt Hollerbach in 2020, in which Bankman-Fried scoffed at the Kelly criterion and said that “I, personally, would do more” than the Kelly amount. “Why? Because ultimately my utility function isn’t really logarithmic. It’s closer to linear.” As he tells Lewis, “he had use for ‘infinity dollars’” — he was going to become a trillionaire and use the money to cure disease and align AI and defeat Trump, sure — so he always wanted to maximize returns.

But as Hollerbach pointed out, this misunderstands why trading firms use the Kelly criterion. [8] Jane Street does not go around taking any bet with a positive expected value. The point of Kelly is not about utility curves; it’s not “having $200 is less than twice as pleasant as having $100, so you should be less willing to take big risks for big rewards.” The point of Kelly is about maximizing your chances of surviving and obtaining long-run returns: It’s “if you bet 50% of your bankroll on 1%-edge bets, you’ll be more likely to win each bet than lose it, but if you keep doing that you will probably lose all your money eventually.” Kelly is about sizing your bets so you can keep playing the game and make the most money possible in the long run. Betting more can make you more money in the short run, but if you keep doing it you will end in ruin.

I'm a huge fan of Lewis's work, but I'll probably give this on a pass. SBF is a con-man with a messiah complex who really isn't that bright. I believe that's all I really need to know about him.

* Part of our long running Ituvania thread.

No comments:

Post a Comment