A bit more background on one of reasons the New York Times housing article we've been discussing made me so angry (though in fairness, it is actually a significant improvement over what we've been seeing from the NYT on the subject).

Western mega-fires fall into that distressingly familiar category of dire crises with obvious solutions that people have alarmingly little interest in fixing. There is no real disagreement over what needs to be done (there hasn't been for decades), but the magnitude is stunning. [emphasis added]

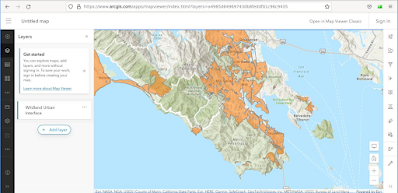

Yes, there’s been talk across the U.S. Forest Service and California state agencies about doing more prescribed burns [a.k.a. controlled burns -- MP] and managed burns. The point of that “good fire” would be to create a black-and-green checkerboard across the state. The black burned parcels would then provide a series of dampers and dead ends to keep the fire intensity lower when flames spark in hot, dry conditions, as they did this past week. But we’ve had far too little “good fire,” as the Cassandras call it. Too little purposeful, healthy fire. Too few acres intentionally burned or corralled by certified “burn bosses” (yes, that’s the official term in the California Resources Code) to keep communities safe in weeks like this.

Academics believe that between 4.4 million and 11.8 million acres burned each year in prehistoric California. Between 1982 and 1998, California’s agency land managers burned, on average, about 30,000 acres a year. Between 1999 and 2017, that number dropped to an annual 13,000 acres. The state passed a few new laws in 2018 designed to facilitate more intentional burning. But few are optimistic this, alone, will lead to significant change. We live with a deathly backlog. In February 2020, Nature Sustainability published this terrifying conclusion: California would need to burn 20 million acres — an area about the size of Maine — to restabilize in terms of fire.

...

[Deputy fire chief of Yosemite National Park Mike] Beasley earned what he called his “red card,” or wildland firefighter qualification, in 1984. To him, California, today, resembles a rookie pyro Armageddon, its scorched battlefields studded with soldiers wielding fancy tools, executing foolhardy strategy. “Put the wet stuff on the red stuff,” Beasley summed up his assessment of the plan of attack by Cal Fire, the state’s behemoth “emergency response and resource protection” agency. Instead, Beasley believes, fire professionals should be considering ecology and picking their fights: letting fires that pose little risk burn through the stockpiles of fuels. Yet that’s not the mission. “They put fires out, full stop, end of story,” Beasley said of Cal Fire. “They like to keep it clean that way.”

Why is it so difficult to do the smart thing? People get in the way. From Marketplace.

Molly Wood: You spoke with all these experts who have been advocating for good fire for prescribed burns for decades. And nobody disagrees, right? You found that there is no scientific disagreement that this is the way to prevent megafires. So how come it never happens?

Elizabeth Weil: You know, that’s a really good question. I talked to a lot of scientists who have been talking about this, as you said, literally, for decades, and it’s been really painful to watch the West burn. It hasn’t been happening because people don’t like smoke. It hasn’t been happening, because of very well-intended environmental regulations like the Clean Air Act that make it harder to put particulate matter in the air from man-made causes. It hasn’t happened because of where we live. You don’t want to burn down people’s houses, obviously.

For better than a hundred years, we’ve been setting too few fires and putting out too many. It wasn’t always like this. The indigenous tribes mastered fire as a forest management tool and used it extensively until the European settlers criminalized the practice, thus setting us up for the disaster facing us today.

The result has been a tinder bundle the size of Maine. Clearing it out is California’s second most serious environmental challenge (after global warming) and is the most urgent problem we face, period. Solving it requires a level of focus and political will that our current governor simply does not have (particularly compared to his predecessor). It’s up to the rest of us to keep this top of mind.

There are huge externalities to these projects, almost none of which can be easily addressed though a conventional regulatory framework. I would need to reach out to experts to be sure, but I doubt environmental impact laws even apply here since we aren’t worried about the direct damage the developments cause to the forests; we’re worried about the damage we’ll cause to the forests trying to protect those developments.

Every dwelling an a forest-adjacent wildland urban interface has got to be treated as, to some degree, expendable, or at the very least, the people who live there need to accept that they are on their own. When frequent controlled burns fill their neighborhoods with smoke, they shouldn't be able to file complaints. When those fires become uncontrolled (as they sometimes inevitably do), they should not have the option of suing.

A planned burn to reduce the threat of wildfire turned into the largest blaze in New Mexico history due to miscalculations, inaccurate models and a lack of understanding of how dry things are in the Southwest, the U.S. Forest Service said Tuesday. https://t.co/VLgpPuKwg5

— The Associated Press (@AP) June 21, 2022

It would be different if these upscale forested developments had any real possibility of having a substantial impact on the housing crisis, but we're talking about badly situated and trivially small pieces of land in the third largest state in the country. They arguably cause more problems than they solve and the disproportionate focus on them distracts us from a situation where we cannot afford distraction.