From Feb, 2017 -- "GOP Game Theory -- things are still different" [Emphasis added.]

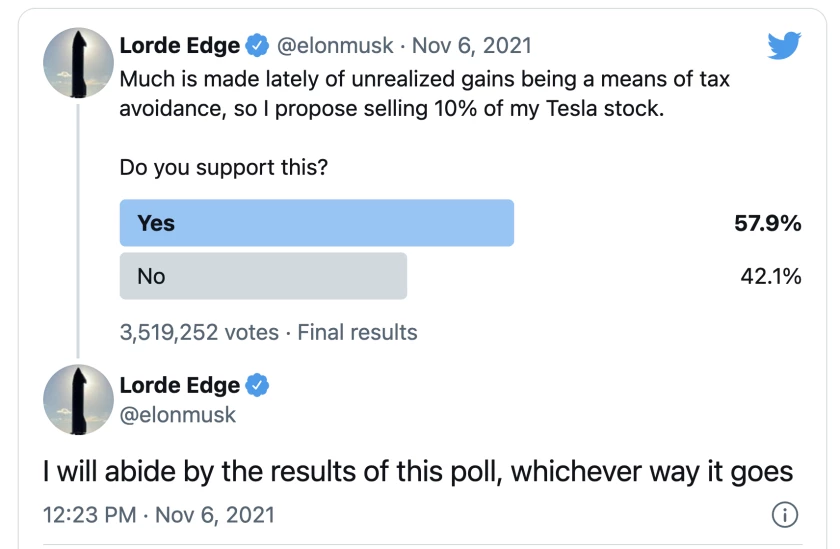

However, while the relationship is simple in those terms, it is dauntingly complex in terms of the pros and cons of staying versus going. If the Republicans stand with Trump, he will probably sign any piece of legislation that comes across his desk (with this White House, "probably" is always a necessary qualifier). This comes at the cost of losing their ability to distance themselves from and increasingly unpopular and scandal-ridden administration.

Some of that distance might be clawed back by public criticism of the president and by high-profile hearings, but those steps bring even greater risks. Trump has no interest in the GOP's legislative agenda, no loyalty to the party, and no particular affection for its leaders. Worse still, as Josh Marshall has frequently noted, Trump has the bully's instinctive tendency to go after the vulnerable. There is a limit to the damage he can inflict on the Democrats, but he is in a position to literally destroy the Republican Party.

We often hear this framed in terms of Trump supporters making trouble in the primaries, but that's pre-2016 thinking. This goes far deeper. In addition to a seemingly total lack of interpersonal, temperamental, and rhetorical constraints, Trump is highly popular with a large segment of the base. In the event of an intra-party war, some of this support would undoubtedly peel away, but a substantial portion would stay.

From TPM -- "Fuming Trump Told RNC On Final Day As POTUS He Was Starting New Party, Book Says" [Emphasis added.]

According to an ABC News’ report on correspondent Jonathan Karl’s upcoming book “Betrayal,” Trump reportedly told Republican National Committee chair Ronna McDaniel during his last Air Force One flight as president that he was leaving the GOP to start a new party.

It was a quest for revenge against a party that had failed to help Trump steal the 2020 election, Karlin wrote.

“You cannot do that,” McDaniel reportedly told Trump. “If you do, we will lose forever.”

“Exactly. You lose forever without me,” he responded, according to Karl. “I don’t care.”

The inevitable damage of him potentially leaving the party was what Republicans “deserve” for “not sticking up for me,” Trump reportedly told the RNC chair.

It wasn’t an empty threat, Karl wrote. Trump was “very adamant” that he was going to do it, a source told the reporter, and he considered it a done deal at that point.

But RNC leaders were actually prepared to strike back, according to the book.

They reportedly reminded Trump and his team that there were “a lot of things they still depended on the RNC for” — specifically, money.

For starters, the RNC would stop paying the mountain of legal fees Trump had racked up with his lawsuits in his crusade to overturn the election via the courts, RNC officials reportedly warned.

The RNC would also render the Trump campaign’s coveted email address list of forty million Trump supporters “worthless,” in Karl’s words. Trump had reportedly generated what RNC officials had estimated to be about $100 million by renting out the list to other GOP candidates.