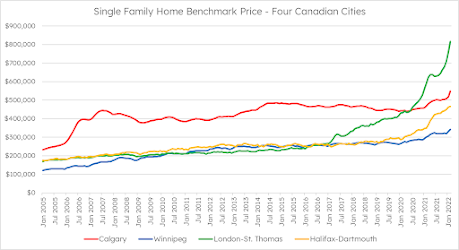

Mike Moffat posted this interesting graph:

The clear loser was Winnipeg, going from a little over $100K to a little over$ 300K, in terms of appreciation but the increase in inflation for the time period is $100 going to $134.61. So even the coldest Canadian market is briskly outpacing inflation. But Southern Ontario went from around $150K to over $800K. It seems odd that housing has exploded in value by so much across so many markets. None of them are even remotely close to the inflation rate, far exceeding it.

But the inability to secure affordable housing has numerous downstream social consequences -- from increased homelessness, inability to escape domestic violence, and financial instability.

And this is not just a Canada problem. Look at housing prices in Seattle: in June of 2005 the average sale price was around $250K whereas in Jan 2022 it was around $800K and by Feb it was $814K (here the peak was before this at $870K). US inflation over this period was about 45% so you are seeing more than a doubling of real costs in the real estate market.

This means that we should think carefully about this from a policy perspective, keeping in mind that feeding a bubble is a bad idea.

EDIT: A typo found by clever commenter DJL has been corrected. The correction is in bold

"is being briskly outpaced by inflation."

ReplyDeleteShouldn't this be "is briskly outpacing inflation.:???

Thank you for the correction. Yes, a typo

ReplyDelete