I don't remember if I've mentioned this recently, but Michael Hiltzik is far better at his job than anyone the NYT has working this beat.

From the LA Times:

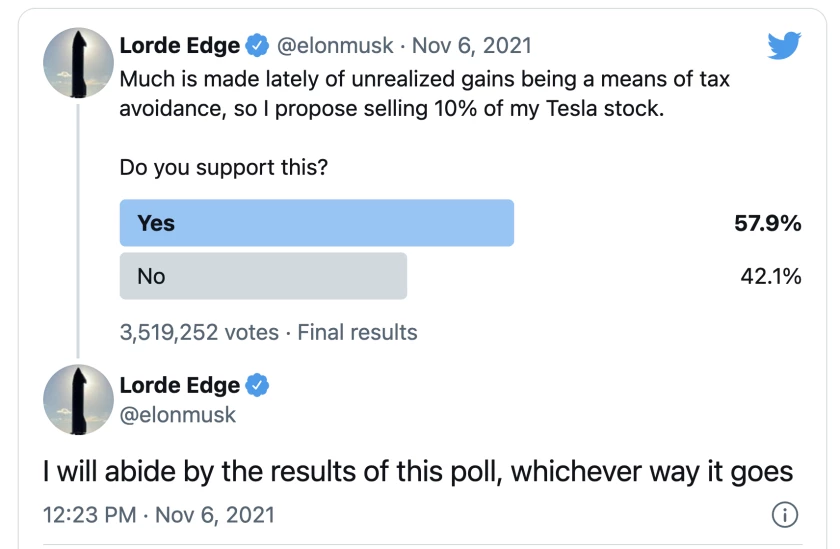

Musk’s approach earned brickbats from people who think seriously, not whimsically, about the social and economic implications of concentrated wealth.

One is Sen. Ron Wyden (D-Ore.), who crafted the proposal that drew Musk’s ire. Wyden’s plan, which hasn’t survived the legislative give-and-take on Capitol Hill, would have taxed the unrealized gains in capital assets such as stock each year. Under current law, capital gains aren’t taxed until the asset is sold — providing wealthy people with convenient means to avoid the tax for years, decades and even forever.

“Whether or not the world’s richest man pays any taxes at all shouldn’t depend on the result of a Twitter poll,” Wyden tweeted. He was seconded by UC Berkeley economist Gabriel Zucman, who helped design a billionaires tax proposed during the last presidential campaign by Sen. Elizabeth Warren (D-Mass.).

...

As of June 30, Musk was reported to own 244 million shares of Tesla, or about 23% of its stock. That includes 73.5 million shares Musk is due from exercising 2012 stock options that expire at the end of August 2022.

The common estimation of Musk’s wealth is largely dependent on the price of Tesla shares, which were trading at about $1,181 as these words were being written. That placed a value of about $288 billion on Musk’s stake.

More than 88 million of those shares are pledged as collateral on debts Musk has accumulated, according to Tesla’s 2021 proxy statement. That’s a clue to how the ultrawealthy avoid paying more than a pittance of tax on their wealth: They borrow against it to cover living expenses. Loans like those aren’t reportable as taxable income, so it’s free and clear. Rich stockholders can wait to sell until conditions are most advantageous.

Even more troubling, if they hold the assets until their death, the embedded capital gains tax is extinguished entirely; their heirs will owe tax only on the gain in value between the date of death and when they sell, if ever.

Musk, moreover, may have reason to pare down his Tesla holdings unrelated to the Twitter vote. For one thing, Tesla shares are riding at record levels just now, so it might make sense for him to cash out at least some of them while the getting is good. Further, he actually does face what looks like an inescapable tax bill next year, when Musk exercises the options on 73.5 million shares.

At current prices, Musk’s gain on the exercise would come to more than $20 billion. At the top federal and California income tax rates, or 54.1%, he would owe about $11 billion. Selling 10% of even the 170.5 million shares he has in hand now, pre-exercise, would bring him more than $20 billion, more than enough to cover the looming tax bill and perhaps even to pay down some of his existing debt.

By pretending that his stock sales were mandated by his Twitter voters, Musk forestalls any speculation that they reflect his doubts about Tesla’s future or about its stratospheric stock market valuation. Tesla shares have fallen by more than 3% as of trading Monday midday, presumably because of the poll result, but they might have fallen even further if Musk’s stock sales came out of the blue.

And in case you're wondering how Elon Musk reacts when someone tries to raise his taxes, click on the following NSFW link.

I genuinely couldn't believe Musk just said this moments ago, even though I am a massive Musk critic, and I went and checked his timeline and, yes, that's what the richest man on the planet, the supposed tech genius, said in response to a U.S. senator calling for higher taxes (!)

— Mehdi Hasan (@mehdirhasan) November 8, 2021

No comments:

Post a Comment