We talk a lot about AI here at the blog, but so much of our time is spent down in the weeds that it's easy to lose sight of just how massive and multifaceted this story is, to the extent that it might be better to think of it as a collection of major narratives sharing a common link. In terms of impact, the biggest of these narratives is probably the AI boom—or, viewed from another set of assumptions, the AI bubble.

It is difficult to wrap one's head around just how big this story is.

Robert Armstrong writing for FT:

There are loads of interesting narratives in that chart (look at the decline of GE, in light grey, for example). But it is worth noting that 30 years ago the industries of the biggest companies were, in descending order, industrials, energy, consumer staples, tech, pharma, consumer staples, tech, retail, tech, consumer staples. Today, the list goes tech, tech, tech, tech, tech, tech, tech, tech, finance, finance. In 2000, there were five tech companies in the top 10. But five years later, three of them were gone; another slightly disconcerting precedent.

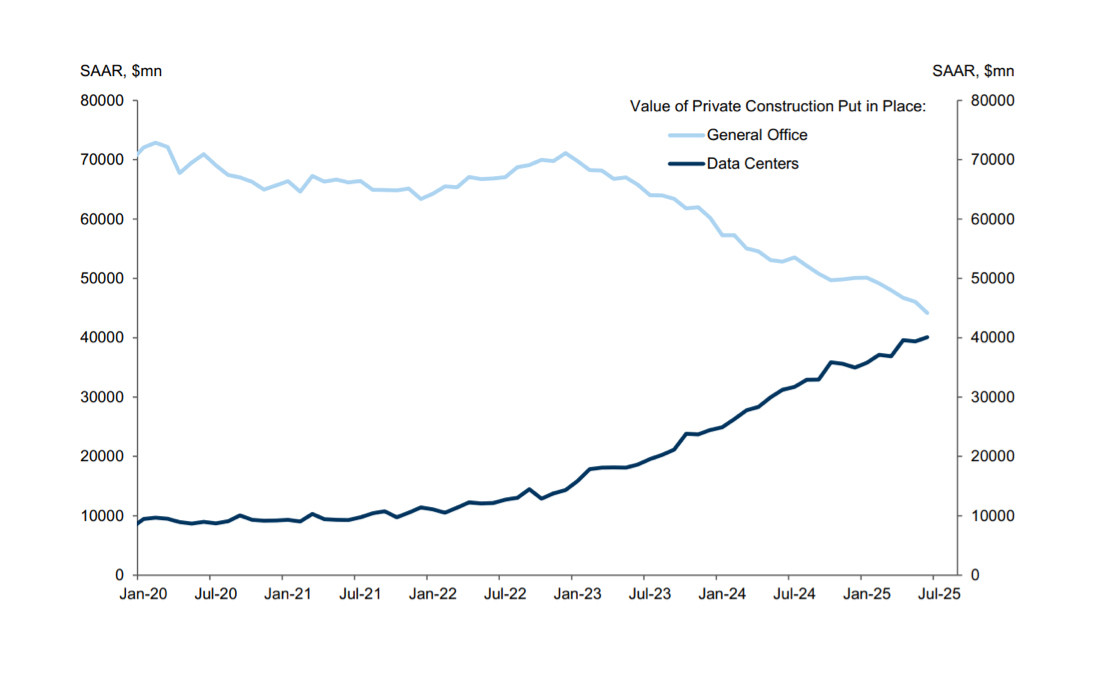

The industry represents around a third of the S&P 500. AI spending contributed more to the economy's growth than did the U.S. consumer. Data center construction has exceeded office construction. "But [AI] increasingly looks like the only game in town for growth. Housing, consumption and government spending — nearly 90% of the economy — are now stagnant at best.”

Hiltzik for the LA Times:

That’s the principle undergirding the AI industry’s vast expenditures on data centers and high-performance chips. The demand for more data and more data-crunching capabilities will require about $3 trillion in capital just by 2028, in the estimation of Morgan Stanley. That would outstrip the capacity of the global credit and derivative securities markets. But if AI won’t scale up, most if not all that money will be wasted.

The hype has been almost unprecedented, but for now, real world performance has been underwhelming and people are starting to get nervous.

Meta freezes AI hiring, WSJ reports reut.rs/4fPDc1x

— Reuters (@reuters.com) August 20, 2025 at 6:30 PM

[image or embed]

Today feels different, in part because the narrative appears to be seeping into the markets, which have been resistant to the dour "are we in a bubble?" vibes. NVIDIA earnings end of month may bring their smiles up, but there's a lot of days of trading between now and then.

— Ed Zitron (@edzitron.com) August 19, 2025 at 1:41 P

[image or embed]

In addition to the scale. there are a number of other reasons to be more concerned about the AI

bubble than the dot-com bubble, not the least of which is the state of

the larger economy. Observers are pointing out indicators of stagflation

that haven't been around for almost 50 years. Add to that a federal

government that is increasingly run by the corrupt and the

incompetent—the very last people you would want in charge during an

economic crisis.

No comments:

Post a Comment