Today's column in the New York Times is another reminder of why Paul Krugman is so essential. It directly contradicts some of the most cherished conventional wisdom about the relationship between education and economic opportunity, but he doesn't say anything that I haven't been hearing from researchers and academicians.

It is a truth universally acknowledged that education is the key to economic success. Everyone knows that the jobs of the future will require ever higher levels of skill. That’s why, in an appearance Friday with former Florida Gov. Jeb Bush, President Obama declared that “If we want more good news on the jobs front then we’ve got to make more investments in education.” But what everyone knows is wrong.

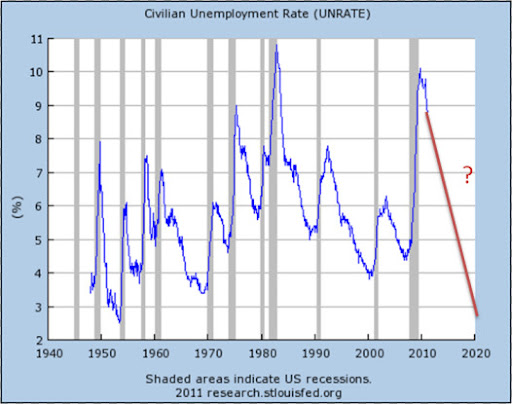

... The fact is that since 1990 or so the U.S. job market has been characterized not by a general rise in the demand for skill, but by “hollowing out”: both high-wage and low-wage employment have grown rapidly, but medium-wage jobs — the kinds of jobs we count on to support a strong middle class — have lagged behind. And the hole in the middle has been getting wider: many of the high-wage occupations that grew rapidly in the 1990s have seen much slower growth recently, even as growth in low-wage employment has accelerated.

Why is this happening? The belief that education is becoming ever more important rests on the plausible-sounding notion that advances in technology increase job opportunities for those who work with information — loosely speaking, that computers help those who work with their minds, while hurting those who work with their hands.

Some years ago, however, the economists David Autor, Frank Levy and Richard Murnane argued that this was the wrong way to think about it. Computers, they pointed out, excel at routine tasks, “cognitive and manual tasks that can be accomplished by following explicit rules.” Therefore, any routine task — a category that includes many white-collar, nonmanual jobs — is in the firing line. Conversely, jobs that can’t be carried out by following explicit rules — a category that includes many kinds of manual labor, from truck drivers to janitors — will tend to grow even in the face of technological progress.

And here’s the thing: Most of the manual labor still being done in our economy seems to be of the kind that’s hard to automate. Notably, with production workers in manufacturing down to about 6 percent of U.S. employment, there aren’t many assembly-line jobs left to lose. Meanwhile, quite a lot of white-collar work currently carried out by well-educated, relatively well-paid workers may soon be computerized. Roombas are cute, but robot janitors are a long way off; computerized legal research and computer-aided medical diagnosis are already here.

And then there’s globalization. Once, only manufacturing workers needed to worry about competition from overseas, but the combination of computers and telecommunications has made it possible to provide many services at long range. And research by my Princeton colleagues Alan Blinder and Alan Krueger suggests that high-wage jobs performed by highly educated workers are, if anything, more “offshorable” than jobs done by low-paid, less-educated workers. If they’re right, growing international trade in services will further hollow out the U.S. job market.

As a statistician, I might quibble with the "If they're right."

So what does all this say about policy?

Yes, we need to fix American education. In particular, the inequalities Americans face at the starting line — bright children from poor families are less likely to finish college than much less able children of the affluent — aren’t just an outrage; they represent a huge waste of the nation’s human potential.

This is another point worth dwelling on for a moment. The educational reform movement likes to draw its poster children from poor urban and rural schools. Having taught in both Watts and the Mississippi Delta, I'm usually glad to see attention focused on these areas, but it's clear in this case that the plight of these kids is being used to market general changes in education that have little if any special relevance to the schools that need the help.

But there are things education can’t do. In particular, the notion that putting more kids through college can restore the middle-class society we used to have is wishful thinking. It’s no longer true that having a college degree guarantees that you’ll get a good job, and it’s becoming less true with each passing decade.

So if we want a society of broadly shared prosperity, education isn’t the answer — we’ll have to go about building that society directly. We need to restore the bargaining power that labor has lost over the last 30 years, so that ordinary workers as well as superstars have the power to bargain for good wages. We need to guarantee the essentials, above all health care, to every citizen.

What we can’t do is get where we need to go just by giving workers college degrees, which may be no more than tickets to jobs that don’t exist or don’t pay middle-class wages.

Update: Lawrence Mishel makes some important related points

here.