[the next few of these come in response to this

Matt Taibbi piece in Rolling Stone brought to our attention by

Andrew Gelman.]

There is a lot of silliness to unpack here. Friedman has always been really bad on technology. A once solid reporter Peter-Principled into the role of "deep thinker" columnist, he spends his time cheerfully regurgitating flawed conventional wisdom on the subject. This is particularly notable with one of his favorite topics, MOOCs, but more on that later.

For now, though, I want to briefly address a side issue that is been bothering me for a long time, the way Friedman and other writers in the field have come to use the term "moonshot."

If we are talking about Apollo program as a template for projects to advance science and technology, it needs to mean "do something very big on a very aggressive schedule by spending huge amounts of money as fast as you can." Of course, there were other contributing factors, but if you want the bullet point explanation, that's it. For a relatively brief period, political and economic conditions lined up so that the LBJ administration was able to convince the country to let it spend

somewhere close to 5% of the federal budget in direct and indirect funding for what was, in the short term, almost entirely a symbolic accomplishment. Even under ideal conditions that was a tough sell.

Did the program eventually pay for itself? Possibly many times over. Most scientific research provides a good return on investment. In terms of immediate payout however, we showed the world that we could beat the Russians to the moon, we produced a genuinely inspirational moment for the nation, and we provided work for as many engineers as the country could supply. That was about it.

The pour-as-much-money-as-possible-as-fast-as-possible-onto-the-problem model does not work equally well in all situations and it may not be the best approach overall, but it was the model for most of the achievements that the "visionaries" of today are so fond of invoking.

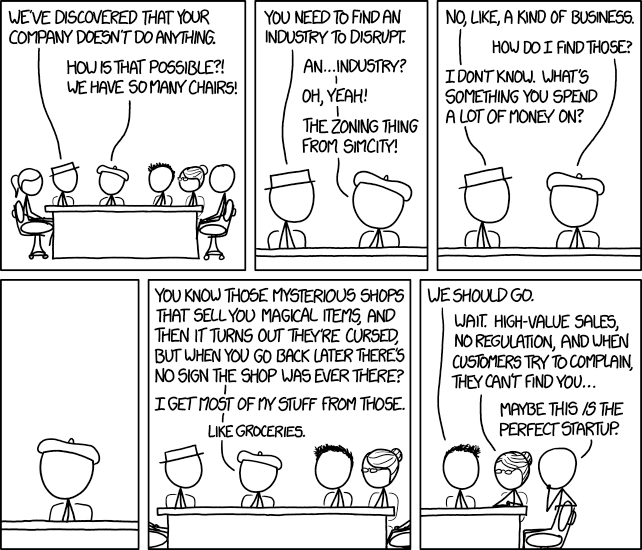

Today, "moonshot" has come to mean pick some cool-sounding futuristic project, hype it with a comically vague proposal, a few neat 3-D graphics, and the inevitable TED Talk, then proceed with some half-assed R&D, making sure to give overblown press conferences for anything that can be packaged as an advance. If it all possible, combine the story with a profile of a visionary Silicon Valley billionaire.

The purpose of today's "moonshots" is to make us all feel excited about living on the verge of a bright and wonderful future without actually having to do any of the work or make any of the sacrifices required to bring that future to fruition.