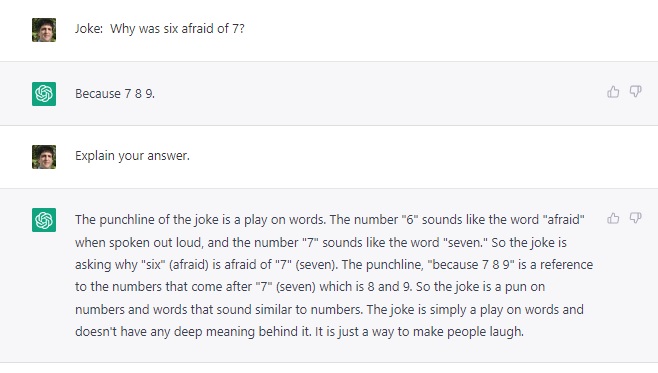

As is often the case, the best thumbnail comes from Matt Levine.

And so if you were the Bank of Startups, just like if you were the Bank of Crypto, it turned out that you had made a huge concentrated bet on interest rates. Your customers were flush with cash, so they gave you all that cash, but they didn’t need loans so you invested all that cash in longer-dated fixed-income securities, which lost value when rates went up. But also, when rates went up, your customers all got smoked, because it turned out that they were creatures of low interest rates, and in a higher-interest-rate environment they didn’t have money anymore. So they withdrew their deposits, so you had to sell those securities at a loss to pay them back. Now you have lost money and look financially shaky, so customers get spooked and withdraw more money, so you sell more securities, so you book more losses, oops oops oops

For those who prefer their analysis in tweet-sized bites, Krugman has an excellent thread. Here are some excerpts.

...OK, some very early morning thoughts on SVB, and why it probably isn't a harbinger for the banking system as a whole — why this is unlikely to be another Lehman moment 1/

— Paul Krugman (@paulkrugman) March 11, 2023

...There were two problems with this business model. First, the bank attracted big accounts, far larger than the 250K insured by the FDIC, making it vulnerable to a classic bank run. Second, it didn't really have any expertise in putting that money to work 5/

— Paul Krugman (@paulkrugman) March 11, 2023

...Conventional banks also earn money from credit card balances, which is similar but even more so, with a lot of inertia in the customer base 7/

— Paul Krugman (@paulkrugman) March 11, 2023

...The reason is option value: short rates can go up but not down. Which means that betting on the spread is risky. If and when short rates go up, you're in trouble. They did, and SVB was. 10/

— Paul Krugman (@paulkrugman) March 11, 2023

And because SVB was basically buying agencies and Treasuries, which are safe assets, its failure won't cause anything like the crash in MBS and run on repo that followed the Lehman collapse. Systemic issues much less obvious 13/

— Paul Krugman (@paulkrugman) March 11, 2023

What I don't have a sense of is how much this will damage the VC financial ecosystem — or how much the rest of us should care. But — hoping these aren't famous last words — this looks at most like a fairly narrow sectoral crisis 14/

— Paul Krugman (@paulkrugman) March 11, 2023

"Cultivating relationships" is a bit of an understatement.

Why did so many startups keep all their cash in SVB?

— Daniel Feldman (@d_feldman) March 11, 2023

If you took loans from SVB, you had to jeep your cash in SVB. If you took investment money from most VCs, you were strongly encouraged to keep your money in SVB.

There really wasn’t much of a choice.

Josh Marshall has also been keeping an eye on the story.

One thing that has come out of my exchanges with readers is unclarity about just what counts as a “bailout”. In one sense it is in the eyes of the beholder: a bailout is when someone else gets it. The more important thing is that term has no real or precise meaning. In general it’s any radical departure from the existing legal/contractual set of rules and obligations in response to a financial crisis. Websters defines it as a “rescue from financial distress.” Clearly the shareholders, i.e., the owners, of Silicon Valley Bank should be wiped out entirely or at least be last in line for any proceeds if the bank goes through a liquidation. They had a business and it failed.

The operative question is the bank’s depositors. What’s being discussed is whether the FDIC should step in and guarantee all the deposits rather than just the 2% or 3% which the FDIC guarantees up to $250,000. What complicates the question is that SVB did very, very little consumer banking. It mainly held deposits of venture capital funds and the start-ups those funds invested in. As noted earlier, the bank likely has enough or close to enough assets to cover all deposits. What it lacks is time and liquidity. So the best solution is for the bank to be purchased by another bank which has time and liquidity. Depositors are protected; risks to the broader economy are prevented; employees at the businesses which banked there have their paychecks covered. That is certainly what regulators are trying to accomplish right now. The question is what happens if they can’t. What basically all the high profile Silicon Valley notables are demanding now is that the FDIC back all the deposits. That’s a bailout by any definition. The point I tried to make above is that such a move could only be justified by grave risk to the broader economy. And that’s a factual question that regulators at the Fed, the FDIC and the Treasury will have to answer.

Still somehow it doesn't feel like a true Silicon Valley disaster until someone from the PayPal mafia makes an appearance.

“The run began on Thursday, when a powerful Silicon Valley VC—Peter Thiel’s Founders Fund—began advising its portfolio companies to withdraw their money from SVB.” That’s not fishy AT ALL. https://t.co/qz2VWwEFKI

— Mueller, She Wrote (@MuellerSheWrote) March 11, 2023

Today, Peter Thiel’s Founders Fund has no exposure to SVB. The person did not say if the firm’s cash withdrawals happened on Thursday, as the startup world was panicking about SVB’s financial position, or earlier. https://t.co/d0o6JwHC1K

— Bruno J. Navarro (@Bruno_J_Navarro) March 11, 2023

3/ is more properly seen as the cause. As knowledgable observer partly explains here. pic.twitter.com/yDiOguwdOb

— Josh Marshall (@joshtpm) March 11, 2023

And for those who are here mainly for the outrage...

Cool coolhttps://t.co/N5AWlQRQUX

— THE PERSUADERS by Anand Giridharadas (@AnandWrites) March 11, 2023

“Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses that led to its failure.”https://t.co/928h9z6Clt

— Ken Klippenstein (@kenklippenstein) March 11, 2023

Silicon Valley Bank on Friday paid out annual bonuses to eligible U.S. employees, just hours before the bank was seized by the U.S. government https://t.co/5ofDsRkGTP

— Anthony DeRosa (@Anthony) March 11, 2023

And schadenfreude.

Forbes should just give up on making lists at this point. https://t.co/hSrigILmwN

— Dare Obasanjo (@Carnage4Life) March 10, 2023

Silicon Valley types don't have a great track record as judges of political risk, so I'm guessing their gonna want to find out how low the public appetite for a tech sector bailout is the hard way.

— E.W. Niedermeyer (@Tweetermeyer) March 10, 2023

And another member of the PayPal mafia pops his head in.VCs are in full "call your congressman" mode about all the startups that can't access funds at SVB and will fail to make payroll next week. Lots of calls for the feds to guarantee all SVB deposits, over FDIC limits. Bank has failed, but hasn't been unwound yet.

— E.W. Niedermeyer (@Tweetermeyer) March 10, 2023

Before vs. after bank runs pic.twitter.com/gIF1GFJ3P2

— Ken Klippenstein (@kenklippenstein) March 11, 2023

— Sam Biddle (@samfbiddle) March 10, 2023

Sometimes people decide they really want the government involved after all. https://t.co/veusWxauCn

— Josh Marshall (@joshtpm) March 10, 2023

Now, if we could just get three members of the PayPal mafia...

What could go wrong? https://t.co/aHzA8hgFy2

— Charles Gaba (@charles_gaba) March 11, 2023

Agreed https://t.co/WZdbPkrB5O

— Grady Booch (@Grady_Booch) March 11, 2023

— E.W. Niedermeyer (@Tweetermeyer) March 11, 2023

every thought leader in the valley is a libertarian until they need a government bailout of their startup bank

— rat king 🐀 (@MikeIsaac) March 10, 2023

If the government won’t bail out my Silicon Valley Bank holdings, I’m going to become an even bigger libertarian.

— New York Times Pitchbot (@DougJBalloon) March 11, 2023

Just as there are no atheists in Fox Holes, there are also no Libertarians during a financial crisis... https://t.co/0kucxNm7vk

— Barry Ritholtz (@ritholtz) March 11, 2023

This tweet works best if you imagine Bill rocking himself in fetal position while you read it. https://t.co/PQDopxZ5EV

— Linette Lopez (@lopezlinette) March 11, 2023

And just as we were going to the presses...

JOINT STATEMENT FROM POWELL, YELLEN AND GRUENBERG:

— Brendan Pedersen (@BrendanPedersen) March 12, 2023

*SVB has been resolved and "fully protects all depositors. Depositors will have access to all of their money" tomorrow

*New York's Signature Bank has been closed

full statement here:https://t.co/QS8ruEys18 pic.twitter.com/awFwZEqkzP

As it should be. https://t.co/ZMmlQ8ozL3

— Grady Booch (@Grady_Booch) March 12, 2023

Under most economic theories, "bank run" does not lead to "increased shareholder value", but A+ for effort

— @chimeracoder@mastodon.social🦦 🏳️🌈 (@chimeracoder) March 12, 2023