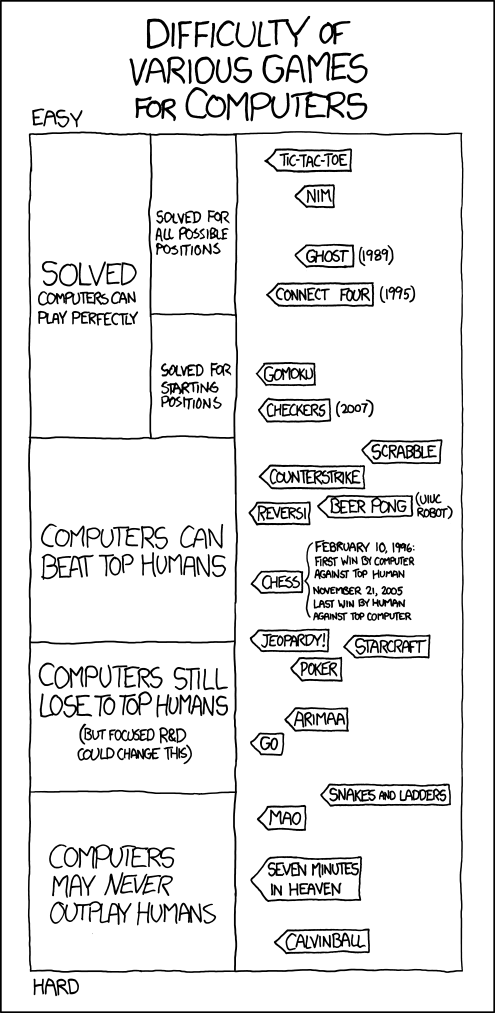

Aaron Carroll has a smart point about the limitations of the current office visit model of health care. He looks at the percentage of people who have trouble getting care on nights and weekends. It seems that we don't do especially well, even on international standards:

Yeah, we beat Canada. But we lose to almost every other country. Almost two thirds of Americans have trouble getting care on nights, weekends, and holidays. You know what? A significant amount of the week is filled with nights, weekends, and holidays. Especially if you don’t want to miss work. It’s fine to believe that people should try and see the doctor in the office. But if you want that to happen, then you need the office to be available. If retail clinics do a much better job in that respect, you can’t complain when people make use of them

I think that there are two points of interest here. One, while Canada has a laudable health care system, it has flaws too and so a straight out effort to clone it might overlook opportunities to do better.

The second is that these visits don't even have to be expensive. Nurses in small retail clinics (you do not even have to have a medical doctor) could diagnose a lot of minor conditions, refer patients to emergency rooms in a crisis, and give instructions for minor care. Now consider that Pharmacies are open 24 hours in a lot of places. They have a medical professional with a doctorate behind the counter who is an expert on medications. Why could pharmacists not prescribe based on the Nurse's diagnosis. Both pharmacists and nurses are cheaper than medical doctors, used to shift work, and highly trained professionals.

Why could they not do a lot more to simultaneously reduce costs (as clinics are inexpensive, provide an alternative to hyper-expensive emergency rooms, and could get patients seen faster) and improve service (would you spend $75 to get easy treatment for an infection at 11 pm on a Saturday night?).

Why aren't me trying out these sorts of innovations?