Comments, observations and thoughts from two bloggers on applied statistics, higher education and epidemiology. Joseph is an associate professor. Mark is a professional statistician and former math teacher.

Sunday, December 25, 2022

Saturday, December 24, 2022

Friday, December 23, 2022

Thursday, December 22, 2022

If you've gone through the holidays without hearing Sugar Rum Cherry...

... you have not had a cool Christmas.

Wednesday, December 21, 2022

Actually, the kids' atomic energy lab wasn't as horrifying as you'd think, but the cabbage patch doll with a taste for human flesh...

Though it takes away a bit of the romance, the Gilbert U-238 Atomic Energy Laboratory wasn't as dangerous as it sounds.

The professional journal IEEE Spectrum published a more-detailed review in 2020, discussing the kit in the context of the history of science education kits and safety concerns. It described the likely radiation exposure as "minimal, about the equivalent to a day’s UV exposure from the sun", provided that the radioactive samples were not removed from their containers, in compliance with the warnings in the kit instructions.

The Bulletin of the Atomic Scientists published a brief article on the web, which featured Voula Saridakis, a curator at the Museum of Science and Industry (Chicago) hosting a detailed video tour of the Atomic Energy Lab components. She concluded by saying that the kit failed to sell because of its high price, and not due to any safety concerns at the time.

Tuesday, December 20, 2022

Christmas with CollegeHumor

My favorite Katie Marovitch sketch.

Monday, December 19, 2022

Housing supply

This is Joseph.

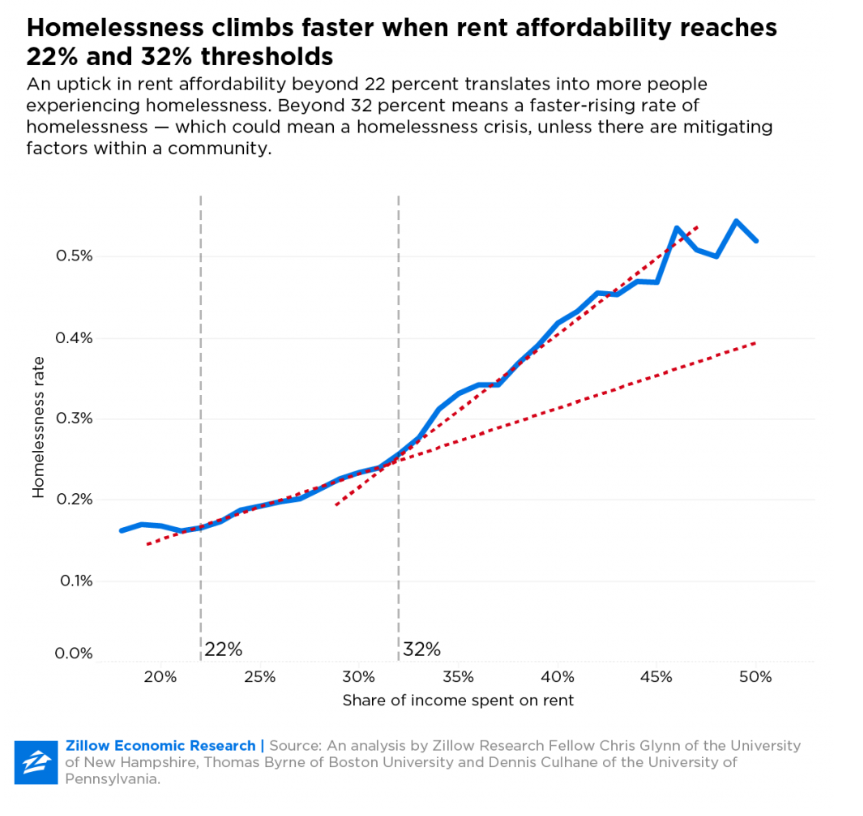

Twitter has been discussing homelessness after the recent Jerusalem Demsas article which really places the blame for homelessness on housing costs and supply. I am not completely convinced that asset inflation and the rise of the REIT has not accelerated an underlying problem, but it is becoming beyond doubt that this is an important part of the picture and one that imposes enormous social costs.

Homelessness and rent affordability.

The inflection point in this graph is alarming. It is clear that zoning in Canadian cities, for example, favors detached housing (60% of the area of Toronto) which limits the ability of the market to build enough housing.That said, I am not sure that this criticism is really well aimed:

The small-c conservative belief that people who already live in a community should have veto power over changes to it has wormed its way into liberal ideology. This pervasive localism is the key to understanding why officials who seem genuinely shaken by the homelessness crisis too rarely take serious action to address it.

I would instead tend to say that it is the elites in these locations that are important; few people in poverty are going to be upset that house prices are not going up. Instead it is the need to appeal to middle class homeowners that is the issue. And, honestly, this suggests that a lot of the solution is to push the decisions about zoning much further up the political ladder. We see some early signs of this in California.

The truth is that we need to stop worrying about preserving neighborhood character and accept that things change. Here is Ken White talking about losing an online space he had once valued. It is the same for cities. All of places I loved when I first lived in Seattle are gone (university village Barnes and Noble, Half price books, Bauhaus cafe, Wayward Coffeehouse, Northgate mall, The Dreaming comics) and that is with the keeping of single family zoning. Living places need to grow, evolve, and change.

I just hope we can allow the growth before the homelessness crisis gets any worse.

Friday, December 16, 2022

Well, that heated up rather quickly

Remember yesterday, when we talked about Musk suspending Elon's Jet, the automated twitter account that posted publicly available data about the flight plans of Musk's private jet. James Fallows (himself a pilot) walks us through the details.

1/n Here's something about flying "general aviation" airplanes— basically everything but airliners or the military, from tiny crop dusters to big corporate jets.

— James Fallows (@JamesFallows) December 16, 2022

Most of what you do is *public information.* Registration and tail numbers of airplanes. Certificate info on pilots.

The jet-setting was something Musk would rather people not talk about -- It doesn't go with the whole monastic planet warrior thing -- so we all knew he'd look for an excuse to kill it. What he came up with was an unverified claim of stalking that didn't seem to have anything to do with the flight tracker

Hard to know what possible case Musk cld have against this kid, though he cld use his billions to try to crush him w frivolous actions. And what possible connection does plane tracking have to this purported attack on his car? https://t.co/KdmjzMOKHQ

— Josh Marshall (@joshtpm) December 15, 2022

When people started looking into this, Musk escalated.

Free speech!? Elon Musk's Twitter suspends several journalists' accounts without notice for criticizing him!https://t.co/D97Cv7IdLM

— Laurence Tribe (@tribelaw) December 16, 2022

Details: The following accounts were suspended on Thursday night...

- New York Times tech reporter Ryan Mac

- Washington Post tech reporter Drew Harwell

- Journalist Aaron Rupar

- CNN politics and tech correspondent Donie O'Sullivan

- Mashable tech reporter Matt Binder

- Sports and political commentator Keith Olbermann

- The Intercept tech reporter Micah Lee

- Voice of America's chief national correspondent Steve Herman

So in the ten minutes since I did this tweet, someone who replied to my tweet already got suspended. pic.twitter.com/L2hQFdQR5K

— Josh Marshall (@joshtpm) December 16, 2022

2/ LAX is like a whole city. The idea that you can know a private jet landed there and have any idea where that person is or where their car is leaving the airport or anything like that is totally absurd.

— Josh Marshall (@joshtpm) December 16, 2022

audio of elon musk joining @katienotopoulos twitter space, getting pushback about his bogus claims, and storming out (h/t @CrymsonDawn) pic.twitter.com/QEXC7HPWrV

— Marisa Kabas (@MarisaKabas) December 16, 2022

Then Musk started going after Twitter's main competitor.

Seriously this is bullshit. pic.twitter.com/D3UQ1xO7pM

— Bye bye Elon (@binarybits) December 16, 2022

They’re slapping warning labels on mastodon links now pic.twitter.com/Tm0GpzT3Aq

— Julie Millican (@JMillzDC) December 16, 2022

👽 @joinmastodon official account has been banned on Twitter pic.twitter.com/qOSe7nRj2W

— Alex Barredo 📉 (@somospostpc) December 15, 2022

Just tried to post a link to my Mastadon account and Twitter blocked my tweet as “harmful”

— Sahil Kapur (@sahilkapur) December 16, 2022

Here it is 👇 pic.twitter.com/h8RRhS1bWA

On the bright side.

The Twitter debacle *might* be a good thing in the long run, as it is a stark reminder that no private company should be trusted to be the "public square".

— François Chollet (@fchollet) December 16, 2022

Invest in platforms you control or that you can easily migrate away from (with your audience). https://t.co/0fbg7xUvaO

Thursday, December 15, 2022

Thursday Tweets

For starters, Musk World has been really busy.

There's A LOT going on here that will/should prompt advertisers to flee. It includes Musk:

— Avi Bueno (@Avi_Bueno) December 11, 2022

1) mocking trans folks

2) pushing anti-vax garbage

3) being celebrated by anti-vax leader RFK Jr

4) calling for Fauci to be prosecuted

5) fully transforming into an alt right goon pic.twitter.com/8NZ54XPJ4z

There seems to be little limit to Elon Musk's predatory and malevolent nature. He is now insinuating that the fmr head of Trust & Safety at Twitter, an openly gay Jewish man, is a pedophile. Just another level of this is that Roth actually stayed on for several weeks under Musk.. pic.twitter.com/hTHZ6SNQEO

— Josh Marshall (@joshtpm) December 10, 2022

Column: By embracing anti-Fauci and QAnon conspiracies, Musk tests how low Twitter can sink https://t.co/Jynx6Rm22u

— Michael Hiltzik (@hiltzikm) December 14, 2022

Why does anyone for one minute think this is a mistake? How many chances are you going to give him to prove who he is? https://t.co/xzbxweeoB0

— Rachel Vindman 🌻 (@natsechobbyist) December 14, 2022

Another reminder that, yes, he (or perhaps it should be He) really does talk that way, and not just on twitter.You ought to hear him on the TED stage.

Social media in general, especially Twitter, were eroding civilization. If civilization collapses before Mars becomes self-sustaining, then nothing else matters.

— Elon Musk (@elonmusk) December 13, 2022

Human consciousness is gone.

He is the messiah he has been waiting for. pic.twitter.com/M0HA18J4oF

— Rumpole the Brief 🇺🇲🇺🇦 (@WendellSherk) December 14, 2022

Weird how all these too-online nerds who supposedly studied science have religious apocalyptic visions of the future and DELUDED savior complexes. https://t.co/GKIZhfCjed

— Linette Lopez (@lopezlinette) December 14, 2022

They are always telling us to read the Constitution. pic.twitter.com/r5Isu2DAcn

— Ron Filipkowski 🇺🇦 (@RonFilipkowski) December 13, 2022

Musk embracing QAnon and the alt-right gives the New York Times a chance to run another "Neo-Nazi's rantings are more nuanced than you think" piece, but it's not one of their better ones.

By @Froomkin. No paywall. https://t.co/SQefD5y5xL pic.twitter.com/q6Udx1rFfV

— Jay Rosen (@jayrosen_nyu) December 13, 2022

I guess no one at NYT had access to Twitter’s search function? pic.twitter.com/8rKWsBHjmT

— Eric Columbus (@EricColumbus) December 10, 2022

The most laughable claim in this consistently off-the-mark analysis is that Musk's actions are somehow "improving the image of his new $44 billion property."/1 https://t.co/LzazLfomBx

— Lawrence Glickman (@LarryGlickman) December 10, 2022

I was remined by a Twitter user that I wrote this (very critical) post about Jeremy Peters of the New York Times in 2014. https://t.co/Ti6D5m30h1 Eight years later, it holds up pretty well, I think.

— Jay Rosen (@jayrosen_nyu) December 14, 2022

While reading the following thread, pay close attention to Marshall's points and remember that Elon lies a lot.

The creator of the account has a screenshot of a slack message by Ella Irwin, Twitter Trust And Safety head requesting that his account be visibly filtered. Three days later, it's banned. https://t.co/ZyOZcF0Pyv

— Alejandra Caraballo (@Esqueer_) December 14, 2022

Doesn't really raise questions as much as it answers them https://t.co/Clp9km8S09

— Kai Ryssdal (@kairyssdal) December 14, 2022

2/ jet tracking doesn’t identify a car or where the car is or who owns the cars. It tells you a plane has landed at an airport, which basically tells you jack. Like maybe this car incident happened but did it have anything to do with this kid?

— Josh Marshall (@joshtpm) December 15, 2022

2/ is absurd. This is publicly available information. You can go to a flight tracking site and find this information in seconds. Anyone who has the slightest interest in harming anyone can easily get that info. Anyone who just wants to show up at an airport and flip Elon ...

— Josh Marshall (@joshtpm) December 15, 2022

And on the business side.

TSLA hits a 2+ year low today, even as the market as a whole rises. pic.twitter.com/s35tyngzqX

— Brian Tyler Cohen (@briantylercohen) December 14, 2022

ICYMI: Elon Musk's Twitter isn't paying its bills https://t.co/iAYvkroEse

— Dan Primack (@danprimack) December 14, 2022

Steve Martin pretending to give a eulogy for Martin Short on SNL:

— Duty To Warn 🔉 (@duty2warn) December 11, 2022

“I’ll never forget Martin’s last words: ‘Tesla autopilot engage.’”

Elon Musk shouting "I'm rich, bitch," while the sound people at Chappelle's show honk a horn to drown out the boos from the crowd is one of the saddest videos I've ever seen. https://t.co/tJHFRhKU3w pic.twitter.com/SeeLSZG93h

— Matt Novak (@paleofuture) December 12, 2022

Elon Musk Receives Experimental Neuralink Implant In Attempt To Delete Memory Of Being Booed https://t.co/iL39zKCkQZ pic.twitter.com/ibkkLxerEr

— The Onion (@TheOnion) December 13, 2022

As we've said before...

DeSantis = Trump + Anti-Vax - Personality

DeSantis announces a new anti-CDC: "Our CDC, at this point, anything they put out, you just assume, at this point, that it's not worth the paper it's printed on ... we're creating what we're calling the Public Health Integrity Committee." pic.twitter.com/BZTu2ljzZL

— Aaron Rupar (@atrupar) December 13, 2022

Did Polio write this tweet? https://t.co/ylPyxBy3s0

— Janet Johnson (@JJohnsonLaw) December 14, 2022

Make no mistake, this is ALL about his primary opponent, who pushed to get these vaccines out at “warp speed” - Donald John Trump. This is his main wedge issue for him with the anti-vax MAGA base regarding Trump. pic.twitter.com/sExJBcITvr

— Ron Filipkowski 🇺🇦 (@RonFilipkowski) December 13, 2022

It's been very, very obvious Ron DeSantis was courting the anti-vaccine movement. The pro-vaccine conservatives chose to deny this fact rather than try to stop it. It's a case study in the conservative movement's intellectual dysfunction. https://t.co/rhsRsh1F1z

— Jonathan Chait (@jonathanchait) December 13, 2022

DeSantis screams that covid vaccines are unsafe, and the pro-vaccine right keeps pretending he's just attending to process issues. Textbook sanewashing. https://t.co/P5puxZRrtr

— Jonathan Chait (@jonathanchait) December 14, 2022

Only the savviest politicians get to use 'secret weapons.'

DeSantis could attack Trump's COVID record from the right in 2024 https://t.co/1cSkWEQ2PC

— New York Times Pitchbot (@DougJBalloon) December 8, 2022

Questionable Political analysis from AP

Delete your account https://t.co/LNe6qhpbcC

— Norman Ornstein (@NormOrnstein) December 14, 2022

Exit polls had young voters:

— Simon Rosenberg (@SimonWDC) December 14, 2022

18-29 63-34 +29D

18-44 55-42 +13D

This data is in line with high quality pre-election polls.

The AP VoteCast data (+12D 18-29) is just way off, and should not be taken seriously. https://t.co/wAQMTwAZCF

This is all based on AP Votes Cast, which is (despite its name) a poll. And it’s an outlier poll when it comes to young voters. Exits showed Dems +30 with voters under 30. https://t.co/3qv22120gN

— Tom Bonier (@tbonier) December 14, 2022

Good thread by Pepper.

🚨 🚨

— David Pepper (@DavidPepper) December 14, 2022

SUPPRESSION ALERT

A 🧵

There’s a reason I started my book “Laboratories of Autocracy” by describing a traffic jam in Hamilton County.

And it’s because nothing provides a more simple and clear example of the motivation behind relentless…

1/ pic.twitter.com/tGrqd2fKVP

...

In cities such as Atlanta, Detroit, Milwaukee, Philadelphia, Cleveland, etc., Black voters disproportionately voted early, and disproportionately used drop boxes—allowing them to avoid the long lines they often face on Election Day or voting in-person early.

— David Pepper (@DavidPepper) December 14, 2022

9/

...

From Florida to Texas, Georgia to Ohio, legislators have pushed outright bans, restrictions on hours, limitations on locations, and the like

— David Pepper (@DavidPepper) December 14, 2022

The bill rushing through in Ohio takes an already absurd limitation of one drop box location per county….and now limits that sole…

12/

...

Like other states, the bill would also limit the hours of the drop box being available to the hours that the elections office itself is open.

— David Pepper (@DavidPepper) December 14, 2022

Which of course makes zero sense.

Imagine if the USPS were to do the same with the mailboxes located outside their offices!

14/ pic.twitter.com/xosr3lQmnH

Just because the election is over does mean this story should go away.

Maternal death rates in states that restricted abortion were 62% higher than in states where abortion was more easily accessible, new research showed. https://t.co/X0traGOP1s

— NBC4 Washington (@nbcwashington) December 14, 2022

Speaking of stories we should be paying more attention to...

From perusing the news, you would never know right-wing militias are blowing up power substations. You woiuld think that would be bigger news. Hmmm...

— Joe DiSano (@ApexCuddler) December 10, 2022

What do you mean "we"?

This acknowledgment that *Attacking Teachers From Every Angle Is Not the Way to Improve Schools* matters because Edsall has long been a mouthpiece for the education reform wing of the Democratic party https://t.co/UhuZWZHFu8

— Jennifer Berkshire (@BisforBerkshire) December 14, 2022

I’m sorry this person experienced distressing symptoms, however, it’s irresponsible to say she overdosed on fentanyl by touching a dollar bill, especially since that is scientifically impossible. Pleading for help & gasping for air are the opposite of what is seen in fentanyl OD. pic.twitter.com/RVj9h06iT6

— Ryan Marino MD (@RyanMarino) December 14, 2022

Desantis supporter during his Governor campaign spray paints over his face because he won’t back Trump for 2024. pic.twitter.com/MAb0P6om2r

— Ron Filipkowski 🇺🇦 (@RonFilipkowski) December 14, 2022

A former boss of mine (back when I was still in Arkansas) used to say that Southern Baptists are firm believers in serial monogamy.

A very, very good point from @EJDionnehttps://t.co/iVu3cCp1TD pic.twitter.com/F0T8oZUiVi

— Natalie Jackson (@nataliemj10) December 11, 2022

And Misc

I guess "stop disputing my paper, I'll send you to prison" is at least a novel response. Who needs open scientific debate when you can silence your critics by throwing them in jail???

— Health Nerd (@GidMK) December 14, 2022

Siri, please give me an egregious example of someone who does not understand software-intensive systems.

— Grady Booch (@Grady_Booch) December 14, 2022

Wait. That's two examples. But thank you, Siri. https://t.co/UW6oHb68LS

FYI I have the POV that “search” a very different use case than “give me an answer to my question”.

— Grady Booch (@Grady_Booch) December 14, 2022

Took conflate or confuse the two would be a serious mistake . https://t.co/LR9atBGy1y

If you don’t mind that, from time to time, that calculator gives you answers that look right but that are most definitely wrong. https://t.co/2BsKTj1FDW

— Grady Booch (@Grady_Booch) December 9, 2022

Insightful thread.

Looking at the output of a deep learning model trained on human-generated data and believing the model is "intelligent" in the human sense is exactly like looking at motion-captured CG and believing the characters on the screen are "alive".

— François Chollet (@fchollet) December 10, 2022

In 2022, we

— Derek Thompson (@DKThomp) December 8, 2022

- reversed organ death in pigs

- made the first embryo from stem cells

- made a pan-influenza vaccine

- saw the beginning of time

- got best-ever results from cancer & obesity therapy trials

- maybe cracked the case of multiple sclerosishttps://t.co/U24emm7aoA

#ChatGPT: remarkably coherent prose full of half-truths intermingled with boldly stated falsehoods masquerading as truths.

— Grady Booch (@Grady_Booch) December 7, 2022

To an outsider, this is astonishing.

To an expert in this domain, this is nothing more than well-formed statistical nonsense at scale. pic.twitter.com/knj5URhxME

“Here’s what it means for coffee lovers and the future of brand marketing.”

— Grady Booch (@Grady_Booch) December 9, 2022

Absolutely nothing. https://t.co/vhuvEf3YWZ

Wednesday, December 14, 2022

Essential catalogs -- Part 1 (this one kind of got away from me)

Since the following is critical of this post by Josh Marshall, I should start by pointing out that the main thrust of his post, an analysis of the implosion a few years ago of the news industry, is sharp, insightful, and on target. Definitely a must read if you have any interest in the topic.

Where Marshall goes off track is in his comments on the state of the streaming industry.[Problem areas emphasized.]

You may have noticed that storied Disney CEO Bob Iger is back in his old job after successor Bob Chapek was unexpectedly fired last month, the corporate equivalent of a drumhead trial and summary execution. The issues at Disney are partly the bearish stock market, partly Chapek’s poor performance. But the central issue is managing Disney’s transformation or attempted transformation into a streaming behemoth. You may already subscribe to Netflix or Amazon Prime or Hulu or AppleTV. If you do, maybe you’ll sign up for one or two more such services. But not more than that. There’s been a furious competition to be one of those one or two more. Under his long tenure at Disney, Iger made a series of acquisitions — Marvel, the Star Wars franchise, Fox entertainment and more — that made that plausible. Now the future of Disney as a streaming business is in question and that is a central reason why Iger is back.

Normally I wouldn't make such a big deal over this, but Marshall's comments reflect the conventional wisdom and there are few subjects on which conventional wisdom has been so consistently and entirely wrong about as it has been with the future of streaming. If you go back 8 or 10 years and read all of the major publications on the subject, you will see that virtually every major assumption and prediction has been proven comically off base.

One of the standard tenets was that Netflix was on track to become both vertically integrated and the absolute leader with substantial monopolistic power. We'll get to the vertical integration later. How about the market dominance?From TechCrunch:

Disney reported results for the final quarter of its 2022 fiscal year today, revealing a total of 164.2 million Disney+ global subscribers, an increase of 12 million subs from 152.1 million in Q3. The flagship streaming service was only expected to gain 9.35 million subs.

Across Disney’s streaming services, Disney+, Hulu and ESPN+ had a combined total of 235.7 million subscribers, up from 221 million in the third quarter. The company beat expectations of 233.8 million.

“2022 was a strong year for Disney, with some of our best storytelling yet… and outstanding subscriber growth at our direct-to-consumer services, which added nearly 57 million subscriptions this year for a total of more than 235 million,” said Bob Chapek, chief executive officer, The Walt Disney Company, in the letter to shareholders.

The company overtook rival Netflix for a second time, despite Netflix reaching 223.09 million global subscribers during its third quarter.

We could go back and forth on whether comparing Netflix to the Disney bundle is the most valid approach -- there's no right answer to that one -- but you can't really talk about an "attempted transformation into a streaming behemoth." Chapek is a textbook Peter Principle idiot, but Disney is, by at least one reasonable metric, the biggest streaming service and if you believe the standard narrative about first mover advantage and the market only supporting only two or three platforms, running this division at a loss for a while is perfectly defensible.

But we need to throw in an important bit of context here.

While most of the money and virtually all of the attention goes to 'originals,' viewers mainly spend their time watching older shows. Pretty much all of the subscription based services other than Netflix, and AppleTV have large, often huge catalogs. Even Amazon, which is pursuing a partnership-based model, jumped in with MGM. Not only has Netflix never shown any interest in acquiring existing catalogs; many of its originals such as House of Cards and She-Ra actually belong to other companies. When Disney spends big money on the Mandalorian, it will cashing in on baby Yoda for years; When Netflix spends big money on the new Airbender show, Paramount will be cashing in for years.

If Netflix had such an overwhelming lead, this might not matter that much. If the company had effective monopsony power over the streaming industry, the studios would have to play ball, but that is not and very probably will never be the case, which leaves Netflix, of all the platforms, by far the most dependent on its competitors. (If you go back eight or ten years, that monopsony assumption was a fundamental part of the standard narrative, It didn't make sense then either.)

None of this means that Netflix is doomed. It's a well-run company with a viable business model as long as things stay basically the same. It is, however, unlikely that Netflix will make it to a final duopoly in anything like its current form. (And, no, the company will never catch up with its competitors' catalogs simply by producing new content, and it doesn't really appear to be trying to.)

But what about the very possibility of a duopoly?

With a handful of exceptions, the major studios (and now, to a limited degree, Amazon) have long controlled every major title, character and franchise you can think of that's not in the public domain, and these are where the money is. Even shows in their fifties and sixties like Andy Griffith and MASH absolutely crush hits like the Crown in terms of viewership. Reboots, sequels and spinoffs of often decades old IP are among the biggest 'new' shows.

Disney was the 800 lb gorilla in intellectual property even before the Fox merger (which was an enormous anti-trust violation, but that's a topic for another post), but valuable properties are spread out among all the majors. Disney, WB, Paramount, Universal, and possibly Columbia all have big enough catalogs to demand some kind of seat at the streaming table.

This doesn't rule out consolidation down to two or three platforms but it does complicate the situation. These four or five have and --barring further studio mergers -- will continue to have content that is essential for the paid streaming industry if it wants to continue being a one-stop-shop. With purely ad-supported platforms nipping at their heels, the subscription services can't afford to chase a large part of their audience to cable or niche streamers or some à la carte option.

A Netflix/Amazon duopoly supported by a small cartel of suppliers might actually be better for consumers than what we have now, but they would be nothing like the vertically integrated behemoths that everyone was predicting a few years ago. If anything, it would be closest to the dynamic of broadcast television before deregulation when the networks were prevented from favoring their own studios.

As for the troubles at Disney, I think Marshall underestimates how much of a rake-stepping idiot Chapek proved to be, walking into political minefields that a competent CEO would have seen a mile off (see the video below), spectacularly screwing up major releases ("the worst opening for a Disney Animation Thanksgiving title in modern times"), spending big money on tons of streaming originals that got lost in the shuffle due to oversupply and bad marketing. Other than solid profits for the parks, perhaps the only accomplishment he has to boast about is Disney+/Hulu/ESPN passing Netflix.

Is "the future of Disney as a streaming business" in question? If we are talking about getting out of streaming entirely, then the answer is obviously no. Will there be some rethinking of strategy and goals? One would certainly hope so. There's plenty of room for cost cutting, much of it low hanging fruit. They could stop trying to maintain Hulu and Disney Plus as more or less autonomous platforms and roll them up together, perhaps with the latter as a premium tier for the former. They could start licensing more of their less valuable properties which would bring in a great deal of revenue (Paramount brings in 6 1/2 billion or so a year following this strategy) In addition to the money, broader licensing is a good way of raising the profile of these lesser properties without crowding out the shows you are trying to push.

For the record, Disney never should have been allowed to accumulate most of this IP. Congress should have stood up for the public domain and against the studio's lobbyists when copyrights were due expire and the Justice Department should have blocked the Fox merger, but they didn't and any analysis worth listening to is going to take these facts into account.

Tuesday, December 13, 2022

One of these things is not like the other

This is Joseph.

These are some recent elections in Arizona that I think give context to a recent announcement on the part of a senator:

2022 Senate

Democratic Mark Kelly 1,322,026 51.40

Republican Blake Masters 1,196,308 46.51

2022 Governor

Democratic Katie Hobbs 1,287,890 50.33

Republican Kari Lake 1,270,774 49.67

2020 Senate

Democratic Mark Kelly 1,716,467 51.16%

Republican Martha McSally 1,637,661 48.81%

2018 Senate

Democratic Kyrsten Sinema 1,191,100 49.96%

Republican Martha McSally 1,135,200 47.61%

Presidential election margins

2016 R + 7

2020 D + 0.3

Now the best comparison is not Bernie Sanders or Angus King, who are rarely making headlines by fighting with the democratic party but instead tend to vote with the party. But the real comparison is Joe Manchin, who often visibly bucks key priorities.

A few numbers from West Virginia

2018 Senate

Democratic Joe Manchin (incumbent) 290,510 49.57%

Republican Patrick Morrisey 271,113 46.26%

Libertarian Rusty Hollen 24,411 4.17%

2020 Governor

Republican Jim Justice 497,944 63.49%

Democratic Ben Salango 237,024 30.22%

Libertarian Erika Kolenich 22,527

2020 Senate

Republican Shelley Moore Capito 547,454 70.28%

Democratic Paula Jean Swearengin 210,309 27.00%

Presidential election margins

2016 R + 13

2020 R + 38

These margins make for a very different electoral landscape. It is not at all clear that anybody could hold West Virginia as a Democrat. If Joe Manchin went independent there would be a really interesting political calculation as to what to do. But, as it is, he is a member of the party in a state that is hard to imagine anyone else winning.

But there is no real evidence that Arizona is not competitive. Since the first breakthrough, there have been two senatorial elections, a gubernatorial election, and a presidential election that have gone to the Democrats. This is much better than Georgia, for example, where the ticket is clearly splitting. Now you might see this as a spoiler play -- let her stay or she'll sink the race but look at her approval ratings in Arizona. At the moment, she is -72 (8% favorable) among Democrats and +19 (44% favorable) among republicans according to these polls and actually at 5% approval among Democrats in these. Meanwhile Mark Kelly is around 90% approval.

Now there might be some sort of backroom deal here but it would involve the federal party completely. Look at the op-ed she published as to why she left:

In catering to the fringes, neither party has demonstrated much tolerance for diversity of thought. Bipartisan compromise is seen as a rarely acceptable last resort, rather than the best way to achieve lasting progress. Payback against the opposition party has replaced thoughtful legislating.

Americans are told that we have only two choices – Democrat or Republican – and that we must subscribe wholesale to policy views the parties hold, views that have been pulled further and further toward the extremes.

Hidden beneath a "both sides narrative" is a clear attack on her party. How do you motivate people to canvas for or campaign for her? She'd have a better chance keeping the Republicans out of the race but that is the other danger with Arizona -- the last presidential and gubernatorial races showed that this is a beatable margin for an popular Republican candidate. Why would they not go for it?

Maybe this move is hidden genius but, sometimes, when you can't see the upside there really isn't one and you are just watching desperation.

Monday, December 12, 2022

The New York Times provincialism problem

Over the years here and elsewhere, we've criticized the way the New York Times covers (or often fails to cover) news from the rest of the country. I've tended to put it down to corporate culture but Michael Cieply (who ought to know) suggested it might be a combination of attitude and economics.

The bigger shock came on being told, at least twice, by Times editors who were describing the paper’s daily Page One meeting: “We set the agenda for the country in that room.”

Having lived at one time or another in small-town Pennsylvania, some lower-rung Detroit suburbs, San Francisco, Oakland, Tulsa and, now, Santa Monica, I could only think, well, “Wow.” This is a very large country. I couldn’t even find a copy of the Times on a stop in college town Durham, N.C. To believe the national agenda was being set in a conference room in a headquarters on Manhattan’s Times Square required a very special mind-set indeed....

Fine. But what about the rest of the universe, that great wide world we were supposed to cover as journalists? As the years went by, it seemed to become more and more distant. One marker passed in the last decade, when the Wall Street Journal made a strategic move on the Times by strengthening its own New York City presence. The Times, by then firmly established as a national paper, went through a spasm of New York-centric thinking, mostly aimed at keeping the local print advertising base intact. Movie stories from far-away Los Angeles became harder to land; theater reviews and elite arts coverage from New York flooded the culture pages.

In theory, the great digital transition should have made it easier for those of us in the bureaus to penetrate the Times’ psyche. But somehow, it didn’t work that way. As quickly as the editorial staff was trimmed in years of successive buyouts and layoffs, it re-grew, largely with a new wave of digital workers, high and low. Many of them were based inside the new Eighth Ave. headquarters; and most seemed to spend much of the time talking about that perennially favorite subject, the New York Times, or buzzing in a digital hive on dozens of Slack channels. It took ever longer to get stories posted or published. More, the paper seemed to lose interest in much that was happening on the ground even in Los Angeles — New York’s palm tree-lined sister city — never mind those half-forgotten spots in Pennsylvania or Oklahoma.

By last summer, a Los Angeles bureau that was built to house 13 had dwindled to four or five inhabitants. Visits by upper editors were rare or nonexistent. Los Angeles stories, especially about the entertainment business, were increasingly written by visiting New York staff members or freelance writers assigned by editors back in Manhattan. The drift was palpable — presumably not just here, but in that heavily populated heartland. And finally, as Spayd said, the paper seemed to lose touch with “the lives and the values of the people who just elected the next president.”

Friday, December 9, 2022

I also had lunch in Truth or Consequences, New Mexico, but I couldn't come up with a song for that one...

Here's a musical itinerary of my recent road trip starting from LA.

Made it out to Needles...

Stood on a corner in Winslow, Arizona (where Jackson Browne's truck breaking down is still a big deal)...

Drove down Route 66...

I would have headed back the same way, but a winter storm blew into Flagstaff so I came back by way of the low desert.

Where they play a little cowboy tune.

And the guitar picker was a friend of mine

By the name of Randy Boone.

And Della got a fire in her eye

The Dealer had a knife and the dog had a gun

and the cat had a shot of Rye.

And passed through Phoenix, probably the only overlap in the catalogs of Glen Campbell and Isaac Hayes.

Warning: this is the long one.

Thursday, December 8, 2022

Magical Heuristics and the Musk Proximity Principle

A few years ago we had a post on how followers of tech messiahs often think in terms we'd normally associate with magic

Magic of association – – properties can be transmitted through proximity (physical or otherwise). This magic is particularly strong in Silicon Valley. Almost any association with someone or something noted for great wealth, success or innovation can pass on these properties. When no direct association is possible, it may be enough to simply invoke the name of a great success which leads us to...

Magic of language – – the proper use of words can alter reality. In addition to the aforementioned example of invoking names like Apple or Google, certain words such as "disruption" are assigned special power. Mission statements actually help determine the fate of companies. Great emphasis is also put on aspirational language which tends to segue into...

Magic of will/belief/doubt – – attitude also shapes reality. Things are more likely to happen the more deeply you believe in them. Correspondingly, skepticism and negative attitudes can undermine this magic. In extreme cases, particularly if surrounded by true believers, there are those who can simply will things into existence which leads us to...

Magic of destiny – – there are chosen ones among us. Their powers are all-applicable, not tied to any specific area or based on specific skills and knowledge; they can simply make things happen. Any association with the chosen ones is unquestionably beneficial. Like messianic American Express cards, they have no preset limits, but they do have at least one weakness: doubters. To question a chosen one is to inspire great hostility.

I guess it was inevitable we'd hit the graven image stage.

Matt Levine (from his newsletter)

“The way finance works now is that things are valuable not based on their cash flows but on their proximity to Elon Musk,” I wrote last year, and while I am not quite sure that it remains true — so far Musk’s proximity seems to be bad for Twitter Inc.’s cash flows, anyway — it is definitely still a part of postmodern financial analysis. In particular, if you have some crypto project, which almost by definition doesn’t have cash flows, you will value Musk proximity very highly. (Look at Dogecoin, etc.)

How can you obtain Musk proximity? I don’t really know — nothing in this column is ever Musk proximity advice — but, look, in these circumstances, it would be understandable if you resorted to techniques of ancient magic? Like if you were to sculpt a giant metal idol of Musk, you might go ahead and assume that the idol would have some valuable magical effect on your crypto project? And if you were to offer up that idol as an gift to Musk himself, and if he were to see it and bless it and accept it and perhaps tweet about it, then that would instill your crypto project with Musk’s divine spirit in a way that would probably make the price of your tokens go up? Is this all stupid? I don’t know? Yes? And yet? All I am saying is that humans have been offering precious idols to divine powers for thousands more years than they have been building discounted cash flow models in Excel. Do the idols have a better long-term track record than the DCF models? That is beyond my expertise. Anyway here is, I think you will have to agree, a thing:

Wednesday, December 7, 2022

Ragnarök -- Twilight of the Canadian University System

MCU’s Proposal prohibits the commencement of a CCAA filing but does not appear to consider the additional cash requirements, increased risk and personal exposure that arises after February 1, 2021 if a CCAA proceeding is not commenced. During our meeting with MCU representatives on January 21, 2021 when the terms of the MCU Proposal were outlined and referred to as final, we asked if MCU was prepared to provide some form of protection or indemnity to Board members for the increased liability that they would be exposed to, if the MCU Proposal was accepted and a CCAA proceeding was therefore not commenced. The response we received was that this would not be provided.

What is this liability?

The letter suggests that the Faculty Union was about to go to court to force the release of documents “that put our financial position, including the historical practice of not setting aside restricted funds, into the public domain”. This, it turns out, is the crux of the matter. The university’s decision, sometime around 2015 probably, to raid the restricted funds for the purposes of funding various renovations and construction (a practice euphemistically referred to as “internal lending” in Laurentian’s Financial Statements – this stuff was hiding in plain sight all along) was simply too embarrassing and a potential cause for litigation against the University and the Board. Entering CCAA and all the chaos that entailed was a preferable alternative to Haché. Indeed, if you read the letter’s schedule B – which sets out the pros and cons of an MCU partial bail-out versus CCAA – one of the main arguments against accepting the Ministry’s offer is that eventually the key details would come out and once the banks and the tri-councils found out about the problem, everything would come crashing down.

The actual cash crunch was caused by early repayment so it looks like the reason for the CCAA was to escape liability for co-mingling restricted funds. This letter was then suppressed by the bankruptcy judge until the end of the process, under the theory that it could disrupt the process.

The idea that you can suck out $30 million in public funds to protect a board from the liability incurred by a breach of their duty of oversight creates some real questions. Like, do we want to allow board's to shed oversight liability so easily? Why was the cost focused on the faculty, with mass layoffs, and not on the board who allowed this co-mingling to occur?

The reason I use the term "Ragnarök" (the fate of the gods) is that I think this outcome is the worst possible public policy result. We insulate the oversight body (already only light accountable) from misconduct and allow the costs to be borne by the institution. Since the costs are huge as compared to the liability shed ($24 million in restructuring plus another $24 million in banking costs versus $36.5 million in now unavailable restricted funds) -- it cost the University almost as much as paying back the restricted funds to do the CCAA.

Which makes it look like an exercise in reducing accountability. It has big implications for the ability to trust a board because if the board makes major accounting errors then it is the faculty who bear the costs (some board members lost their seats, seems different then the loss of a tenured job).

Now it might be that this stays an isolated case. But the breaking of norms and the use of a novel method to avoid liability may well be tempting the next time a board slow walks themselves into a position of considerable liability.