Comments, observations and thoughts from two bloggers on applied statistics, higher education and epidemiology. Joseph is an associate professor. Mark is a professional statistician and former math teacher.

Wednesday, May 5, 2021

"Well, maybe one will come up"

Tuesday, May 4, 2021

Perhaps cultivating learned helplessness is not the best strategy for fighting the pandemic

Note the use of the word "will." There are no qualifiers here. This is our fate because vaccine hesitancy is an unalterable natural constant. Assuming we use the standard of containment rather than eradication (which has almost never happened), this level of certainty is absurd.NEW: The herd immunity threshold for the coronavirus will stay out of reach, because widely circulating variants and persistent hesitancy about vaccines. The virus is here to stay, but vaccinating the most vulnerable may be enough to restore normalcy.https://t.co/q5QOa7IKp8

— Apoorva Mandavilli (@apoorva_nyc) May 3, 2021

MOKDAD: Compared to other viruses, it's somewhere between 75 to 85%. We in the United States are not going to get to herd immunity before this winter simply because right now the vaccine is only authorized for adults, not for children...CHANG: Right.MOKDAD: ...Fifteen or younger. So you have about 25% of your population not eligible for the vaccine.CHANG: OK. But down the road, what is your view? Is herd immunity within reach?MOKDAD: Yes, definitely. Down the road, we can get to herd immunity if we have a vaccine that we can provide to two years or older and if Americans are willing - who are eligible to take the vaccine are willing to go ahead and get the vaccine.CHANG: You're talking about vaccine hesitancy at the moment. How significant do you think vaccine hesitancy is as an obstacle to ultimately achieving herd immunity?MOKDAD: It's the only obstacle that we have right now between us and herd immunity simply because we have many Americans who are not willing to take the vaccine. Otherwise, we have vaccines that are safe and effective, and they will provide herd immunity. And we know children are going to get the vaccine. Twelve to 15 is coming very soon and, after that, 6 to 11.

Monday, May 3, 2021

Josh and the toasty warm take

Environmentalism is supposed to be pain and sacrifice. Because Musk offers an environmental vision that is fun, futuristic and coded with all sorts of “bro” aspects, he is deeply suspicious and must be stopped.

— Josh Barro (@jbarro) April 25, 2021

The first two points establish a mystery to be solved; the third offers an explanation. While Barro may have intended this conclusion to be provocative, he treats the premise as axiomatic, as do many others.

Well also he’s very rich, which a small but vocal group thinks is per se bad.

— Matthew Yglesias (@mattyglesias) April 25, 2021

Exactly https://t.co/33kVqRwvlC

— Alec Stapp (@AlecStapp) April 25, 2021

I don't claim to speak for the left, but:

— E.W. Niedermeyer (@Tweetermeyer) May 1, 2021

-union busting

-poor workplace conditions/safety

-SWATing whistleblowers

-repeated environmental violations (really)

-market manipulation

-unsafe automated driving development/deployment, even by the standards of an unregulated industry https://t.co/gavkrYrkKV

And a whole damned essay by James Pethokoukis.

More deeply, Musk is offering an attractive techno-optimist vision of the future. It's one in stark contrast with that offered by anti-capitalists muttering about the need to abandon "fairy tales of eternal economic growth," as teen climate activist Greta Thunberg has put it. Unlike the dour, scarcity-driven philosophy of Thunbergism, Muskism posits that tech-powered capitalism can solve the problems it causes while creating a future of abundance where you can watch immersive video of SpaceX astronauts landing on Mars while traveling in your self-driving Tesla. As journalist Josh Barro neatly summed it up recently, "Environmentalism is supposed to be pain and sacrifice. Because Musk offers an environmental vision that is fun, futuristic and coded with all sorts of 'bro' aspects, he is deeply suspicious and must be stopped."

You'll notice that that these examples include liberals, conservatives and centrists. This is one of the many cases where trying to approach this with an ideological filter not on fails to help, but actually obscures what's going on. The distinction we need to focus on isn't left vs. right but close vs. far.

I don't know of another case where the standard narrative and the story told by reporters on the front lines diverge this radically, and the gap has only grown larger. In one version Musk is a visionary and spectacularly gifted engineer who, though flawed, is motivated only out of a passion for saving the planet. He does amazing things. In the other, he is a con man and a bully who, when goes off script, inevitably reveals a weak grasp of science and technology. Outside of the ability to get money from investors and taxpayers, his accomplishments range from highly exaggerated to the frauulent.

While this view may not be universal among journalists covering the man, it is the consensus opinion.

The explanations of Barro et al. are not all that reasonable, but they are probably as good as you can get when you start with the assumption that the standard narrative is right.

Friday, April 30, 2021

Sometimes it's useful to stop and think about what really fast progress looks like

That last post got me thinking. Over the past dozen or so years, autonomous vehicles have made impressive advances, but it's important to remember that many researchers had convinced most of the press that level 5 was just around the corner and that the progress we've seen, while substantial, has not been exceptionally fast by historical standards.

Here's a look at what happened in the first decade of powered flight. The pace of breakthroughs was stunning. Just as important, the adjustments people had to make in the way they viewed the world was tremendous.

This was not an isolated case. From the same late 19th/early 20th century period, I could come up with a half dozen similar stories, with perhaps as many coming out of the postwar era. As cool and as significant as many of the developments of the 21st century, from a historical perspective we have a ways to go.

From late 1903:

According to the Smithsonian Institution and Fédération Aéronautique Internationale (FAI), the Wrights made the first sustained, controlled, powered heavier-than-air manned flight at Kill Devil Hills, North Carolina, four miles (8 km) south of Kitty Hawk, North Carolina on 17 December 1903.

The first flight by Orville Wright, of 120 feet (37 m) in 12 seconds, was recorded in a famous photograph. In the fourth flight of the same day, Wilbur Wright flew 852 feet (260 m) in 59 seconds. The flights were witnessed by three coastal lifesaving crewmen, a local businessman, and a boy from the village, making these the first public flights and the first well-documented ones.

To 1913:

A good indication of the progress during the era is provide by the annual Gordon Bennett races. The first competition, held in 1909 during the Grande Semaine d'Aviation at Reims, was over a distance of 20 km (12 mi) and was won by Glenn Curtiss at a speed of 75.27 km/h (46.77 mph). By 1913, the last pre-war contest, the race was over a distance of 200 km (120 mi) and the winner's speed was 200.8 km/h (124.8 mph). At the end of 1909 the record for distance flown was 234.30 km (145.59 mi) and for altitude 453 m (1,486 ft): by the end of 1913 the record for distance was 1,021.19 km (634.54 mi) and the altitude record was 6,120 m (20,079 ft)

Thursday, April 29, 2021

The fact that I could probably pass off a ten year old post on AVs as new suggests that the technology may not be advancing quite as fast as initially promised

In all seriousness, when you look back at periods of ubiquitous revolutionary advances (late 19th/early 20th centuries, the postwar era), you see not only the technology but the conversation around the technology rapidly evolving, changing radically from year to year. I'm not seeing a lot of rhetorical evolution at the moment, certainly not a decade's worth.

WEDNESDAY, JUNE 1, 2011

Tyler Cowen argues against more regulation with an example that calls for more regulation

In case you haven't been following this story, Google has been getting a lot of press for its experiments with self-driving cars, especially after statements like this from Stanford professor Sebastian Thrun:

"Think about the car as a medium of mass transit: So, what if our highway-train of the future meant you go on the highway, and there's a train of very close-driving cars with very low wind drag, fantastic capacity, is twice as efficient as possible as today, and so there is no congestion anymore?"Cowen is clearly thinking along the same lines:

Furthermore, computer-driven cars could allow for tighter packing of vehicles on the road, which would speed traffic times and allow a given road or city to handle more cars. Trips to transport goods might dispense with drivers altogether, and rental cars could routinely pick up customers. And if you worry about the environmental consequences of packing our roads with cars, since we can’t do without them entirely, we still can make those we use as efficient — and as green — as possible.Putting aside the question of the magnitude of these savings in time, road capacity and fuel effeiciency (which, given the level of technology we're talking about here, aren't that great), where exactly are these savings coming from?

Some can certainly be attributed to more optimal decision-making and near instantaneous reaction time, but that's not where the real pay-off is. To get the big savings, you need communication and cooperation. Your ideal driving strategy needs to take into account the destination, capabilities and strategies of all the vehicles around you. Every car on the road has got be talking with every other car on the road, all using the same language and rules of the road, to get anything near optimal results.

Throw just one vehicle that's not communicating (either because it has a human driver or because its communication system is down or is incompatible) into the mix and suddenly every other vehicle nearby will have to allow for unexpected acceleration and lane changes. Will driverless cars be able to deal with the challenge? Sure, but they will not be able to able to do it while achieving the results Thrun describes.

A large number of driverless cars might improve speed and congestion slightly, but getting to the packed, efficient roads that Cowen mentions would mean draconian regulations requiring highly specific attributes for all vehicles driving on a major freeway. The manufacture and modification of vehicles would have to be tightly controlled. Motorcycles would almost certainly have to be banned from major roads. Severe limits would have to be put on when a car or truck could be driven manually.

This would seem to be another case of a libertarian endorsing a technology with less than libertarian implications.

Wednesday, April 28, 2021

Bitcoin and cryptocurrency as modern gold

From Dec. 18, 2017, to Feb. 10, 2018, bitcoin’s value fell by 55%. This year alone there have been three downdrafts of 20% or more over the course of a week or two, and an additional fall of 16% over 12 days in March. (All metrics are from Coinbase.)

This is obviously fatal to the primary idea of bitcoin as currency. It also finishes bitcoin as being a useful basis for financial instruments. Imagine buying a house for 100 bitcoin and then having it have a value of 50 bitcoin (because the coins are now worth more). Bought for 20 bitcoins down, the value of the mortgage is now 80 bitcoins and the house is underwater. How do you make long term investments when you cannot stably value real or financial assets? Here, I am using fait as a proxy for the purchasing power of bitcoin.

But if you wanted a medium of exchange that has all of the pros and cons of bitcoin, then gold is actually a pretty good choice. Hiltzik again:

The problem is that as bad as bitcoin is as an investment, it’s even worse as a currency. Blogger Kevin Drum lists five features that a currency should have: It should be hard to counterfeit, stable in value, easy to carry, widely accepted and 100% liquid. Bitcoin fails three of these tests — it’s not stable in value, widely accepted or 100% liquid.

Now you could imagine gold, minted as coins, being able to do everything that bitcoin could do (including recordless transactions) except we know that it can be both liquid and widely accepted. It can be a pain if it is not coined to assess the value, but the trading features of bitcoin are complicated as well. For example, it clearly has a limit on how frequently it can be traded that greatly limits the ability to be used as a routine payment method. Thomas Lumley looks at how low the actual rate of bitcoin transactions is compared to the number of direct electronic transactions in the New Zealand economy. The short answer is that, for just a small country, bitcoin is way below the scale needed to replace the current financial system. This is bitcoin for the world (about 300,000/day) and just New Zealand for the electronic transfers (looks to be about 5.5 million/day), and Dr. Lumley is quite transparent that these are not directly comparable measures as the blockchain might be bundling several transactions. But bitcoin is closing on on 1% of the world's energy usage, and still seems awful low for the number of transactions for just New Zealand (small, if rich, country).

Now gold can be stolen but you can create financial instruments out of it. Further, bitcoin is vulnerable to theft or loss of a password. Furthermore, it is just as vulnerable to government snooping and law enforcement, due to the long term nature of the blockchain record.

My real question is "what problem does it solve"? Especially compared to alternatives like gold. And, to be clear, gold was uniformly worse than fiat currency as a basis for the economy. I just don't see what bitcoin will do incrementally on gold or how it solves any major currency problem.

Tuesday, April 27, 2021

"None had ever performed such wonderful things in so short a time"

A hardy perennial from Mackay's Extraordinary Popular Delusions.

On the 29th of May, the stock had risen as high as five hundred, and about two-thirds of the government annuitants had exchanged the securities of the state for those of the South Sea Company. During the whole of the month of May the stock continued to rise, and on the 28th it was quoted at five hundred and fifty. In four days after this it took a prodigious leap, rising suddenly from five hundred and fifty to eight hundred and ninety. It was now the general opinion that the stock could rise no higher, and many persons took that opportunity of selling out, with a view of realising their profits. Many noblemen and persons in the train of the King, and about to accompany him to Hanover, were also anxious to sell out. So many sellers, and so few buyers, appeared in the Alley on the 3rd of June, that the stock fell at once from eight hundred and ninety to six hundred and forty. The directors were alarmed, and gave their agents orders to buy. Their efforts succeeded. Towards evening confidence was restored, and the stock advanced to seven hundred and fifty. It continued at this price, with some slight fluctuation, until the company closed their books on the 22nd of June.

It would be needless and uninteresting to detail the various arts employed by the directors to keep up the price of stock. It will be sufficient to state that it finally rose to one thousand per cent. It was quoted at this price in the commencement of August. The bubble was then full-blown, and began to quiver and shake, preparatory to its bursting.

Many of the government annuitants expressed dissatisfaction against the directors. They accused them of partiality in making out the lists for shares in each subscription. Further uneasiness was occasioned by its being generally known that Sir John Blunt, the chairman, and some others, had sold out. During the whole of the month of August the stock fell, and on the 2nd of September it was quoted at seven hundred only.

The state of things now became alarming. To prevent, if possible, the utter extinction of public confidence in their proceedings, the directors summoned a general court of the whole corporation, to meet in Merchant Tailors' Hall, on the 8th of September. By nine o'clock in the morning, the room was filled to suffocation; Cheapside was blocked up by a crowd unable to gain admittance, and the greatest excitement prevailed. The directors and their friends mustered in great numbers. Sir John Fellowes, the sub-governor, was called to the chair. He acquainted the assembly with the cause of their meeting, read to them the several resolutions of the court of directors, and gave them an account of their proceedings; of the taking in the redeemable and unredeemable funds, and of the subscriptions in money. Mr. Secretary Craggs then made a short speech, wherein he commended the conduct of the directors, and urged that nothing could more effectually contribute to the bringing this scheme to perfection than union among themselves. He concluded with a motion for thanking the court of directors for their prudent and skilful management, and for desiring them to proceed in such manner as they should think most proper for the interest and advantage of the corporation. Mr. Hungerford, who had rendered himself very conspicuous in the House of Commons for his zeal in behalf of the South Sea Company, and who was shrewdly suspected to have been a considerable gainer by knowing the right time to sell out, was very magniloquent on this occasion. He said that he had seen the rise and fall, the decay and resurrection of many communities of this nature, but that, in his opinion, none had ever performed such wonderful things in so short a time as the South Sea Company. They had done more than the crown, the pulpit, or the bench could do. They had reconciled all parties in one common interest; they had laid asleep, if not wholly extinguished, all the domestic jars and animosities of the nation. By the rise of their stock, monied men had vastly increased their fortunes; country-gentlemen had seen the value of their lands doubled and trebled in their hands. They had at the same time done good to the Church, not a few of the reverend clergy having got great sums by the project. In short, they had enriched the whole nation, and he hoped they had not forgotten themselves. There was some hissing at the latter part of this speech, which for the extravagance of its eulogy was not far removed from satire; but the directors and their friends, and all the winners in the room, applauded vehemently. The Duke of Portland spoke in a similar strain, and expressed his great wonder why anybody should be dissatisfied: of course, he was a winner by his speculations, and in a condition similar to that of the fat alderman in Joe Miller's Jests, who, whenever he had eaten a good dinner, folded his hands upon his paunch, and expressed his doubts whether there could be a hungry man in the world.

Monday, April 26, 2021

It actually takes some effort to devise arguments this conventional and this wrong

Environmentalism is supposed to be pain and sacrifice. Because Musk offers an environmental vision that is fun, futuristic and coded with all sorts of “bro” aspects, he is deeply suspicious and must be stopped.

— Josh Barro (@jbarro) April 25, 2021

E.W. Niedermeyer's response to that same initial tweet could be read as a rebuttal to Barro.

It's safe to say that no one who has been seriously following Musk and Tesla in the Financial Times, the LA Times, Business Insider, Atlantic, Vanity Fair, Edmunds.com or Wired would attribute the criticism to "fun, futuristic and coded with all sorts of “bro” aspects."98% of the Elon-Rheorical Complex is just making criticism out to be hatred of him. If it's a referendum on his image, he wins (so far). Dig into the facts, and many of his ideas fall apart. If he actually delivered on most of his brainwaves, this would be much more obvious.

— E.W. Niedermeyer (@Tweetermeyer) April 25, 2021

The trouble is, most people paying attention have realized that the man is a habitual liar.

Specifically on the question of climate change, here's a reminder of one reason why environmentalists have been falling out of love with Tesla recently.

Jamie Powell writing for FT Alphaville.

From "Tesla: carbon offsetting, but in reverse"

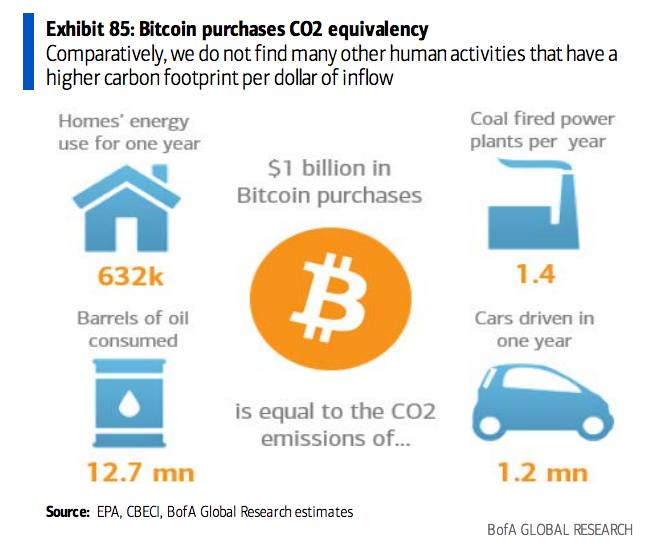

We’re not the first to point this out by any means, but bitcoin is dreadful for the environment. Still don’t believe it? Well Bank of America published an excellent report last week (which can be found on David Gerard’s blog), on the dominant digital coin. And, in particular, its carbon impact.Here are a few choice stats.Bitcoin -- or to be more precise, bitcoin mining -- currently consumes more energy than Greece, and a touch less than the Netherlands. In theory, it wouldn’t be so much of an issue if mining was powered by renewable energy, but 72 per cent of mining is concentrated in China, where nearly two-thirds of all electricity is generated by coal power.For the moment then, bitcoin has carbon emissions that sit comfortably between American Airlines’s output, the world’s largest airline which currently carries 200m passengers per year, and the entire US Federal government.Perhaps the most relevant stat of all, however, is this one:

Friday, April 23, 2021

‘The pastrami must be amazing’

It says something about 2021 that when I read about a scam that drove the valuation of small deli up to $100 million, my first reaction is "just a hundred million?"

A now-disbarred lawyer who pleaded guilty to federal crimes related to shell company scams is listed as an attorney in early financial documents filed by a New Jersey firm whose stock valuation has risen as high as $100 million or more despite owning just a single, small delicatessen.

...

In June 2020, Jaclin pleaded guilty to criminal charges of conspiracy and obstruction of justice. Separately, in a related case, the SEC in 2019 entered a final judgment against him “for running a fraudulent shell factory scheme through which sham companies were taken public and sold for a profit,” a press release noted that year.

...

Hometown International’s stock, which trades on the over-the-counter market, plummeted by about 33% in the hours after trading began Friday morning. A day earlier, CNBC had published articles about the company’s unusually high market capitalization, which was first noted in a letter hedge fund manager David Einhorn sent to clients.

“The pastrami must be amazing,” Einhorn quipped in his letter.

...

Jaclin, who is still serving his sentence of three years of supervised release for his criminal case, did not immediately respond to a request for comment.

The biographies of Morina and Lindenmuth in SEC filings do not mention any prior experience by either of them in the food service industry, a publicly traded corporation, or the financial industry.

Hometown’s deli had sales of just $35,000 or so for the past two fiscal years. The deli was closed from mid-March to early September last year because of the Covid-19 pandemic.

Despite that, its nearly 8 million shares of common stock recently traded at levels of nearly $14 per share, giving it a market capitalization in excess of $100 million.

Thursday, April 22, 2021

Effect sizes and vaccination

This is Joseph

Okay, I want to address a question about effect sizes and vaccination:

Central to all of this reasoning is the intuition of relative effect sizes. Vaccines that reduce mortality by huge amounts are simply unlikely to be causing more harm than good. Further, naturalistic ideals don't really account for the shift from low density hunter gatherer situations (much lower burden of disease) to high density urban environments.

Taken as a whole, vaccines simply look like a super-effective health intervention, even before we consider the network effects.

Wednesday, April 21, 2021

Clash of the Regulatory Titans

NHTSA is great

— Elon Musk (@elonmusk) April 20, 2021

What's Tesla official safety record, it very much depends on whom you ask.

By far the most in-depth investigations of Autopilot-involved crashes were by the @NTSB, and in every case they found that the design of the system contributed to misuse and the crash/death. Not one or the other, but both.

— E.W. Niedermeyer (@Tweetermeyer) April 20, 2021

Has anyone actually read these?https://t.co/LUjsKq5XDV

In Phil's defense, there has been one NHTSA investigation into Autopilot that exonerated Tesla. Following Josh Brown's death, NHTSA produced a report saying Autopilot not only wasn't at fault, but actually reduced crashes by 40%.

— E.W. Niedermeyer (@Tweetermeyer) April 20, 2021

It was comically wrong.https://t.co/450DhJ3tyQ

At first glance the report had obvious problems. When an auto safety expert made FOIA requests to obtain more information about how they had come to the finding NHTSA blocked him. He had to sue to get it, and when he did it was clear why: it was a bad joke https://t.co/450DhJ3tyQ

— E.W. Niedermeyer (@Tweetermeyer) April 20, 2021

NHTSA's inaction on the very specific issues that the NTSB's investigations found in three separate cases, the lack of ODD limits and camera driver monitoring, has left the NTSB extremely frustrated. I encourage you to watch their latest (Feb '20) hearing: https://t.co/T0UkTHocbD

— E.W. Niedermeyer (@Tweetermeyer) April 20, 2021

Why has the @NTSB identified the problems in the complex interaction between human and machine when @NHTSAgov could not? Easy: NTSB investigates crashes of all kinds and thus has deep human factors knowledge/experience, NHTSA is largely a defect investigating body and doesn't.

— E.W. Niedermeyer (@Tweetermeyer) April 20, 2021

That's why NHTSA's only published investigation turned out to be an embarrassment and why nobody, from Elon Musk himself on down, has been able to explain why or how NTSB's findings were wrong... not once, but three times.

— E.W. Niedermeyer (@Tweetermeyer) April 20, 2021

It's because they aren't wrong. They got it right.

For a more deeper dive from Niedermeyer, check out his article in the Drive.

Tuesday, April 20, 2021

The lies we tell ourselves about technology and the future have real costs

Follow-up to yesterday's post.

Not so long ago, the conventional wisdom (except for a few journalists who really understood the challenges) was that the tech for autonomous vehicles was basically in place. The only thing holding us back was excessive regulation and legal concerns. And it wasn't only AVs; the following is from a post we ran in 2018 on that old standby, flying cars:

One of the most cherished tenets of the standard tech narrative is that we would all be living in a wondrous futuristic land – – half sci-fi movie, half amusement park – – if not for those darned regulations. It's a perfect, multipurpose excuse. It teases us with the promise of great things just around the corner. It creates a handy set of villains to boo and hiss. It neatly explains away the failures of tech messiahs to come up with appealing and functional technology or viable business plans.

It is also bullshit. There are certainly cases where onerous regulations hold up big infrastructure projects and you can make the case that the IRB process is delaying certain medical advances, but in the vast majority of cases where a new technology fails to catch on, it is because of incompetent execution, bad engineering or non-feasible business models, but those explanations are difficult to write up, run counter to the standard narrative, and tend to make the journalists look like idiots for having bought the hype in the first place.

Regulators of autonomous vehicles have been more than compliant; with Tesla, they've been negligent, allowing the company to publicly imply to customers that they have level 5 autonomy while privately admitting that they only have level 2 and are far behind companies like Waymo.

Tesla has brought in billions selling a product that doesn't exist, making Elon Musk one of the two richest men in the world. A byproduct of that fraud has been to endanger everyone who owns or shares the road with a car with Autopilot or "Full Self Driving."

Just think of how bad it would be if Musk were in it for the money.

Monday, April 19, 2021

If you've been following the Tesla story, you'll recognize some of these threads

Isn't this as much an FTC matter as NHTSA? I have written about how NTSB wants NHTSA to act on regulating autonomous systems, calling out Tesla's practices. This may interest you: https://t.co/cRMOPtahPD

— Lora Kolodny (@lorakolodny) April 19, 2021

Other car makers that offer hands-free driving options also have safety features that prevent this kind of misuse.

Yep. Good infrared driver monitoring system. https://t.co/g6Gf48RuuA

— Russ Mitchell (@russ1mitchell) April 19, 2021

In addition to the tendency to run into stationary objects, there's this.

This Tesla crash is horrific (also crazy/stupid; no one was in the driver's seat). But the "it takes an entire swimming pool to extinguish a burning Tesla battery" problem seems potentially worse than any self-driving car issues https://t.co/hA1ScyDYB2 pic.twitter.com/3I2cLuFrcx

— John McQuaid (@johnmcquaid) April 18, 2021

The Tesla battery fire issue has been a concern for a while now.

Federal safety officials are probing allegations of defective cooling systems installed in early-model Tesla vehicles.

Tesla installed cooling tubes prone to leaks in Model S vehicles beginning in 2012, according to internal emails cited by Business Insider last week. The Times reviewed copies of the emails and other documentation that show the tubes were installed from 2012 until 2016, at which time Tesla cut off a supplier and began manufacturing the tubes in house.

The National Highway Traffic Safety Administration, in a statement to The Times, said it is “well aware of the reports regarding this issue and will take action if appropriate based upon the facts and data.” The agency also reminded auto manufacturers that they are required “to notify the agency within five days of when the manufacturer becomes aware of a safety related defect and conduct a recall.” Tesla appears to never have issued such notification.

A few people have pointed out that this tendency to combust might be especially problematic in certain situations.

Here’s what the @boringcompany Convention Center loop looks like when the @Tesla is going about 40 mph. Trip is from the Central Station to the South Station. #vegas #BoringCompany #elonmusk 🎥 @LVCVA pic.twitter.com/CREkLc7LKO

— Mick Akers (@mickakers) April 16, 2021

For more on the Tesla Vegas Tunnel, check out Jalopnik.

Friday, April 16, 2021

Dispatches from Ford vs. Tesla

Part 2: These are clips from a 28-minute drive.

— Taylor Ogan (@TaylorOgan) March 16, 2021

There’s a difference between, “The software will get better when the NN has way more data,” vs. hardware ceiled Level 2 ADAS, as even Tesla now admits.

Tesla robotaxi dreamers will have to wait for cars with the proper HW. pic.twitter.com/4RBXCAcNcD

Before we begin, one fact jumps right off the delivery report pages when we analyze the Ford Mustang Mach-E’s delivery volume. The Mach-E entered the market selling at about number 4 overall in the US EV market. Not bad for a new entry. Generally, automakers need six to nine months to reach peak production volumes of a given model, so the Mustang Mach-E could very well be the top-selling electric vehicle in America by later this year. Ford reports the Mustang Mach-E is a conquest model, and that 70% of the Mach-E's buyers come from competitive brands.

Now that you're up to speed.

BlueCruise! We tested it in the real world, so our customers don’t have to. pic.twitter.com/dgqVkWH31r

— Jim Farley (@jimfarley98) April 14, 2021

Here, @elonmusk responds to the announcement of Ford’s competing BlueDrive ADAS system with a clip featuring CEO Jim Farley’s dead cousin Chris. https://t.co/aP0mdELiy6

— Russ Mitchell (@russ1mitchell) April 15, 2021

Here's a good write up of the exchange from the Detroit Free Press.This is messed up of Elon Musk imo -- here, he's using a video of Ford CEO Jim Farley's deceased cousin, the exceedingly talented Chris Farley, to clap back over a bit of friendly brand competition. https://t.co/5QWZP3WYT2

— Lora Kolodny (@lorakolodny) April 14, 2021

And if you still think Elon Musk wouldn't play the dead relative card out of anger, just check with Business Insider's Linette Lopez or the good people at Wired.

Thursday, April 15, 2021

Mathematically impossible profits are often an indicator of questionable business practices

[Emphasis added throughout.]

Jamie Powell at FT Alphaville had interesting reflections on the legacy of Bernie Madoff. In particular, this caught my eye.

Markopolos approached the Securities and Exchange Commission with evidence that Madoff was running a fraud three times between 2001 and 2005. Three times the regulator ignored him. The evidence he presented wasn’t even particularly complicated — one of his findings was that there was simply not enough option volume at the CBOE for Madoff to execute his straddle strategy.

The link leads us to a more detailed account.

After analysing Madoff's vague, broad-brush statements to clients, Markopolos concluded that it was impossible – not only was it mathematically inconceivable to smooth out all the ups and downs in the S&P index's performance, Madoff would need to use more options than existed on the entire Chicago Board Options Exchange, where nobody owned up to seeing any volume from Madoff's firm at all.

This struck a familiar note.

On July 26, the Post started a series of articles that asked hard questions about the operation of Ponzi's money machine. The paper contacted Clarence Barron, the financial journalist who headed Dow Jones & Company, to examine Ponzi's scheme. Barron observed that though Ponzi was offering fantastic returns on investments, Ponzi himself was not investing with his own company.

Barron then noted that to cover the investments made with the Securities Exchange Company, 160 million postal reply coupons would have to be in circulation. However, only about 27,000 actually were in circulation. The United States Post Office stated that postal reply coupons were not being bought in quantity at home or abroad. The gross profit margin in percent on buying and selling each IRC was colossal, but the overhead required to handle the purchase and redemption of these items, which were of extremely low cost and were sold individually, would have exceeded the gross profit. Barron noted that if Ponzi really was doing what he claimed to do, he would effectively be profiting at the expense of a government—either the governments where he bought the coupons or the U.S. government. For this reason, Barron argued that even if Ponzi's operation was legitimate, it was immoral to take advantage of a government in this manner.

Perhaps there's a lesson to be learned here.