ONCE upon a time there was a farmer and his wife who had one daughter, and she was courted by a gentleman. Every evening he used to come and see her, and stop to supper at the farmhouse, and the daughter used to be sent down into the cellar to draw the beer for supper. So one evening she had gone down to draw the beer, and she happened to look up at the ceiling while she was drawing, and she saw a mallet stuck in one of the beams. It must have been there a long, long time, but somehow or other she had never noticed it before, and she began a-thinking. And she thought it was very dangerous to have that mallet there, for she said to herself: 'Suppose him and me was to be married, and we was to have a son, and he was to grow up to be a man, and come down into the cellar to draw the beer, like as I'm doing now, and the mallet was to fall on his head and kill him, what a dreadful thing it would be!' And she put down the candle and the jug, and sat herself down and began a-crying.Well, they began to wonder upstairs how it was that she was so long drawing the beer, and her mother went down to see after her, and she found her sitting on the settle crying, and the beer running over the floor. 'Why, whatever is the matter?' said her mother. 'Oh, mother!' says she, 'look at that horrid mallet! Suppose we was to be married, and was to have a son, and he was to grow up, and was to come down to the cellar to draw the beer, and the mallet was to fall on his head and kill him, what a dreadful thing it would be!' 'Dear, dear! what a dreadful thing it would be!' said the mother, and she sat down aside of the daughter and started a-crying too. Then after a bit the father began to wonder that they didn't come back, and he went down into the cellar to look after them himself, and there they two sat a-crying, and the beer running all over the floor. 'Whatever is the matter?' says he. 'Why,' says the mother, 'look at that horrid mallet. Just suppose, if our daughter and her sweetheart was to be married, and was to have a son, and he was to grow up, and was to come down into the cellar to draw the beer, and the mallet was to fall on his head and kill him, what a dreadful thing it would be!' 'Dear, dear, dear! so it would!' said the father, and he sat himself down aside of the other two, and started a-crying.Now the gentleman got tired of stopping up in the kitchen by himself, and at last he went down into the cellar, too, to see what they were after; and there they three sat a-crying side by side, and the beer running all over the floor. And he ran straight and turned the tap. Then he said: 'Whatever are you three doing, sitting there crying, and letting the beer run all over the floor?' 'Oh!' says the father, 'look at that horrid mallet! Suppose you and our daughter was to be married, and was to have a son, and he was to grow up, and was to come down into the cellar to draw the beer, and the mallet was to fall on his head and kill him!' And then they all started a-crying worse than before. But the gentleman burst out a-laughing, and reached up and pulled out the mallet, and then he said: 'I've travelled many miles, and I never met three such big sillies as you three before; and now I shall start out on my travels again, and when I can find three bigger sillies than you three, then I'll come back and marry your daughter.' So he wished them good-bye, and started off on his travels, and left them all crying because the girl had lost her sweetheart.

Comments, observations and thoughts from two bloggers on applied statistics, higher education and epidemiology. Joseph is an associate professor. Mark is a professional statistician and former math teacher.

Tuesday, April 6, 2021

The Three Sillies

Monday, April 5, 2021

At least it's less than the Netherlands

Jamie Powell writing for FT Alphaville explains why Tesla's recent bitcoin investment is raising questions about the company's environmental priorities.

Tesla: carbon offsetting, but in reverse

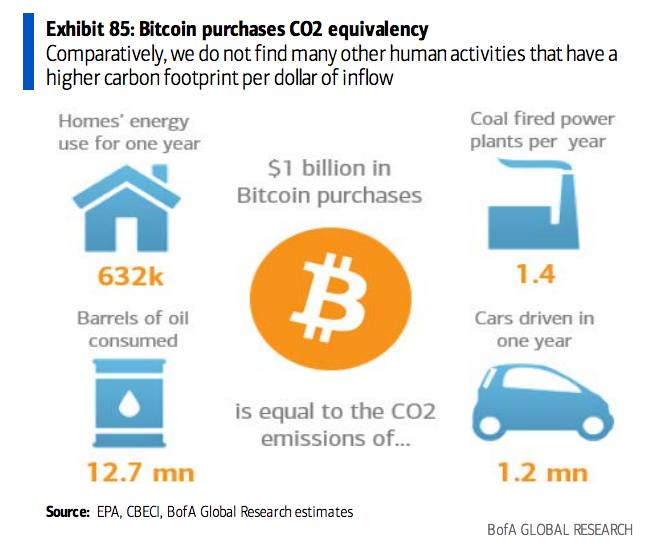

We’re not the first to point this out by any means, but bitcoin is dreadful for the environment. Still don’t believe it? Well Bank of America published an excellent report last week (which can be found on David Gerard’s blog), on the dominant digital coin. And, in particular, its carbon impact.

Here are a few choice stats.

Bitcoin -- or to be more precise, bitcoin mining -- currently consumes more energy than Greece, and a touch less than the Netherlands. In theory, it wouldn’t be so much of an issue if mining was powered by renewable energy, but 72 per cent of mining is concentrated in China, where nearly two-thirds of all electricity is generated by coal power.

For the moment then, bitcoin has carbon emissions that sit comfortably between American Airlines’s output, the world’s largest airline which currently carries 200m passengers per year, and the entire US Federal government.

Perhaps the most relevant stat of all, however, is this one:

A spiked pedrail would be really cool

OK, I really think I've had enough mobility innovation now https://t.co/juyMcQuS2e

— E.W. Niedermeyer (@Tweetermeyer) February 22, 2021

Should have mentioned H.G. Wells was a fan.

Wednesday, July 10, 2019

If not for the development of the caterpillar tread, these would have been big.

Another cool technology with the bad luck to come in second.From Wikipedia:

The pedrail wheel was invented in 1903 by the Londoner Bramah Joseph Diplock. It consists in the adjunction of feet (Latin radical "ped") to the rail of a wheel, in order to improve traction and facilitate movement in uneven or muddy terrain. Sophisticated pedrail wheels were designed, with individual suspension for each foot, which would facilitate the contact with uneven terrain.

Scientific American 1903-04-18

Friday, April 2, 2021

"Hydrodynamics is what a five-year old would do, if a five-year old had a PhD."

Brendan Greeley writing for FT Alphaville (which you should definitely sign up for) explains the physics behind the recent traffic jam at the Suez Canal.

Sailors talk about hydrodynamics the way CEOs talk about macroeconomics: they either treat it with mystical reverence, or they claim to understand it and are wrong. Unlike with macroeconomics, though, if you know what you’re doing you can test the propositions of hydrodynamics on actual, physical models in a lab. As in: you build little boats and then you drag them through the water, in a towing tank. Hydrodynamics is what a five-year old would do, if a five-year old had a PhD.

Lataire works with Flanders Hydraulics Research at what he calls the world’s most accurately constructed shallow-bottom tow tank. He’s currently helping build an even bigger tank, to generate more data for a ship simulator to certify pilots. The tanks are shallow-bottomed, because hydrodynamics in shallow water are different. When a boat moves through the water, it pushes the water out of the way — it displaces it. “Where the water needs to be displaced, in a deep ocean it can go under the ship and that’s not a problem,” says Lataire. “But if it needs to go into shallow water, like the Suez, the water simply cannot go under and around.”The Suez Canal is basically just a 24m-deep ditch dug in the ground to let the ocean in. When a ship comes by and displaces the water, the water has nowhere to go; it gets squeezed in between the ship’s hull and the floor and the sides of the ditch. A ship in a canal can squat, for example — it can dig its stern into the water. When water gets squeezed between a ship’s hull and a sand floor, it speeds up. As water flow speeds up, its pressure drops, pulling the hull down to fill the vacuum. The effect is more pronounced at the stern, and so the ship settles into a squat: bow up, stern down.Lataire wrote his dissertation on a similar phenomenon as a ship passes close to a bank: the bank effect. The water speeds up, the pressure drops, the stern pulls into the bank and, particularly in shallow water, the bow gets pushed away. Stern one way, bow the other. A boat that had been steaming is suddenly spinning. It’s a well-identified phenomenon; in 2009 Ghent University’s Shallow Water Knowledge Centre put together a whole conference about it. Clever pilots on the Elbe, according to Lataire, will use it to shoot around a bend.However: the more water a ship displaces, the stronger the effect. And the closer the side of the hull is to the shore, the stronger the effect. The bigger the ship, the faster the bow shoots away from the bank.

Thursday, April 1, 2021

The almost perfect 2021 business story: funded by the likes of Andreessen Horowitz, feted by goop, it was a massive fraud built around a literal shit company

If only they could have gotten Musk and Thiel involved.

SF poop-testing startup, once compared to Theranos, charged in $60M fraud scheme

Zachary Schulz Apte and Jessica Sunshine Richman, co-founders of defunct microbiome testing company uBiome, are accused of bilking their investors and health insurance providers, federal prosecutors said. They were indicted Thursday on multiple federal charges, including conspiracy to commit securities fraud, conspiracy to commit health care fraud and money laundering.

...

Apte, 36, and Richman, 46, founded uBiome in 2012 as a direct-to-consumer service called “Gut Explorer.” Customers would submit a fecal sample that the company analyzed in a laboratory, comparing the consumer's microbiome to others' microbiomes, prosecutors said. The service cost less than $100 initially.

The company grew to include “clinical” tests of gut and vaginal microbiomes, which were aimed to be used by medical providers so uBiome could seek up to $3,000 in reimbursements from health insurance companies. The federal indictment states that uBiome sought upwards of $300 million in reimbursement claims from private and public health insurers between 2015 and 2019. The company was ultimately paid more than $35 million for tests that “were not validated and not medically necessary."

Apte and Richman met in San Francisco in 2012 through the California Institute for Quantitative Biosciences Garage, an incubator used by UCSF. Together, they founded uBiome and received funding from Silicon Valley investors like 8VC in San Francisco and Andreessen Horowitz in Menlo Park, which hold 22% and 10% stakes in uBiome, respectively, according to court documents.

For a time, they were the latest up-and-coming business determined to disrupt the medical testing industry. In 2018, Richman was even named an "innovator" winner in Goop's "The Greater goop Awards" and at its peak, uBiome was valued at $600 million.

Wednesday, March 31, 2021

"Every fool aspired to be a knave"

Exchange Alley was in a fever of excitement. The Company's stock, which had been at a hundred and thirty the previous day, gradually rose to three hundred, and continued to rise with the most astonishing rapidity during the whole time that the bill in its several stages was under discussion. Mr. Walpole was almost the only statesman in the House who spoke out boldly against it. He warned them, in eloquent and solemn language, of the evils that would ensue. It countenanced, he said, "the dangerous practice of stockjobbing, and would divert the genius of the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, by making them part with the earnings of their labour for a prospect of imaginary wealth." The great principle of the project was an evil of first-rate magnitude; it was to raise artificially the value of the stock, by exciting and keeping up a general infatuation, and by promising dividends out of funds which could never be adequate to the purpose. In a prophetic spirit he added, that if the plan succeeded, the directors would become masters of the government, form a new and absolute aristocracy in the kingdom, and control the resolutions of the legislature. If it failed, which he was convinced it would, the result would bring general discontent and ruin upon the country. Such would be the delusion, that when the evil day came, as come it would, the people would start up, as from a dream, and ask themselves if these things could have been true. All his eloquence was in vain. He was looked upon as a false prophet, or compared to the hoarse raven, croaking omens of evil. His friends, however, compared him to Cassandra, predicting evils which would only be believed when they came home to men's hearths, and stared them in the face at their own boards. Although, in former times, the House had listened with the utmost attention to every word that fell from his lips, the benches became deserted when it was known that he would speak on the South Sea question.The bill was two months in its progress through the House of Commons. During this time every exertion was made by the directors and their friends, and more especially by the Chairman, the noted Sir John Blunt, to raise the price of the stock. The most extravagant rumours were in circulation. Treaties between England and Spain were spoken of, whereby the latter was to grant a free trade to all her colonies; and the rich produce of the mines of Potosi-la-Paz was to be brought to England until silver should become almost as plentiful as iron. For cotton and woollen goods, with which we could supply them in abundance, the dwellers in Mexico were to empty their golden mines. The company of merchants trading to the South Seas would be the richest the world ever saw, and every hundred pounds invested in it would produce hundreds per annum to the stockholder. At last the stock was raised by these means to near four hundred; but, after fluctuating a good deal, settled at three hundred and thirty, at which price it remained when the bill passed the Commons by a majority of 172 against 55.…It seemed at that time as if the whole nation had turned stockjobbers. Exchange Alley was every day blocked up by crowds, and Cornhill was impassable for the number of carriages. Everybody came to purchase stock. "Every fool aspired to be a knave." In the words of a ballad, published at the time, and sung about the streets, "A South Sea Ballad; or, Merry Remarks upon Exchange Alley Bubbles. To a new tune, called 'The Grand Elixir; or, the Philosopher's Stone Discovered.'"

Tuesday, March 30, 2021

Even if scoundrels and fools get huge returns, that doesn't mean the reasons for avoiding scoundrels and fools no longer apply

This well-written paragraph, from @RobinWigg article in the @FT on " #Archegos poses hard questions for #WallStreet", captures well the fallacy of composition issue that I've seen play out repeatedly in finance, and that risks fueling disorderly de-leveraging and distressed sales pic.twitter.com/EIaX8JzBnc

— Mohamed A. El-Erian (@elerianm) March 29, 2021

"Concerns about his reputation and history were offset by a sense of the huge opportunities from dealing with him, according to two of Archegos’s prime brokers. He is known as an “aggressive, moneymaking genius”, according to one analyst note.https://t.co/xrBRYzNXA7

— JC Oviedo (@JCOviedo6) March 29, 2021

This is way out of my field, but you'd think that in a time of SPACs, billion dollar unicorns that lose money on every transaction but hope to make it up in volume, meme stocks, insane volatility, investor cults of personality and P/Es over a thousand, putting aside concerns might be a bad idea.

From Bloomberg:

Bill Hwang, a former hedge fund manager who’d pleaded guilty to insider trading, was deemed such a risk by Goldman Sachs Group Inc. that as recently as late 2018 the firm refused to do business with him.

Those misgivings didn’t last.

Wall Street’s premier investment bank, lured by the tens of millions of dollars a year in commissions that a whale like Hwang paid to rival dealers, removed his name from its blacklist and allowed him to become a major client. Just as Morgan Stanley, Credit Suisse Group AG and others did, Goldman fueled a pipeline of billions of dollars in credit for Hwang to make highly leveraged bets on stocks such as Chinese tech giant Baidu Inc. and media conglomerate ViacomCBS Inc.

Now Hwang is at the center of one of the greatest margin calls of all time, his giant portfolio in a messy and painful liquidation, and Goldman’s reversal has thrust it right into the mayhem.

Monday, March 29, 2021

Vitamin D

Friday, March 26, 2021

AstraZeneca dust-up

This is Joseph

Statement from AstraZeneca was titled (emphasis mine):

AZD1222 US Phase III trial met primary efficacy endpoint in preventing COVID-19 at interim analysis

Gave results of:

79% vaccine efficacy at preventing symptomatic COVID-19

100% efficacy against severe or critical disease and hospitalisation

Comparable efficacy result across ethnicity and age, with 80% efficacy in participants aged 65 years and over

Statement from NIAID:

Late Monday, the Data and Safety Monitoring Board (DSMB) notified NIAID, BARDA, and AstraZeneca that it was concerned by information released by AstraZeneca on initial data from its COVID-19 vaccine clinical trial. The DSMB expressed concern that AstraZeneca may have included outdated information from that trial, which may have provided an incomplete view of the efficacy data. We urge the company to work with the DSMB to review the efficacy data and ensure the most accurate, up-to-date efficacy data be made public as quickly as possible.

Full results from AstraZeneca:

76% vaccine efficacy against symptomatic COVID-19

100% efficacy against severe or critical disease and hospitalisation

85% efficacy against symptomatic COVID-19 in participants aged 65 years and over

So a few points. One, the data was from the interim analysis, even though it was definitely out of date at the time of publication. Still, it was one of two reportable numbers. Noah Haber discusses this here, including noting that the protocol is publicly available.

Two, the media framing looks terrible. Unless the results are misreported, the interim analysis was 3% high in the overall and 5% low in the over 65 participants. These are small changes and kind of average out, given that efficacy in over 65 year old participants was a concern because of under-participation in the earlier AstraZeneca trials. But this framing seems excessive:

Federal officials were taken aback by the board’s allegations. One said the way that AstraZeneca handled the results was the equivalent of “telling your mother you got an A in a course, when you got an A in the first quiz but a C in the overall course.” Another said the disclosure by the board would inevitably hurt the company’s credibility with U.S. regulators.

I am not sure I would consider the two reports materially different. Certainly, I do not see them as being the difference between an A and C (probably I would call them both B's, compared to other trials and the degree of change between them). Since they were doing frequentist statistics, looking at numbers between the two prespecified analyses seems like a bad plan (p-hacking concerns arise). That said, why is the analysis plan not Bayesian?

That said, unless these numbers are false in some way, how is this a major change?

Finally, why doesn't the United States just give up on approving AstraZeneca and agree to allow it to be exported. It is pretty clear that US regulators have decided that they aren't interested in the product but the export restriction is blocking shipping it to other places that could actually use it. Why not be honest, say they won't need it (they don't) and allow it to be exported to other places across the globe who are desperate for vaccines. Isn't it in everybody's best interests to reduce variants by increasing resistance to covid-19 infections globally?

How is this the best plan?

Thursday, March 25, 2021

Repost: I wonder where Republicans got the idea that they could get away with using false claims about election fraud to justify voter suppression

TUESDAY, MAY 3, 2016

Context only counts if it shows up in the first two dozen paragraphs

In the third paragraph, we have two conflicting claims that go to the foundation of the whole debate. If election fraud is a significant problem, you can make a case for voter ID laws. If not, it's difficult to see this as anything other than voter suppression. This paragraph pretty much demands some additional information to help the reader weigh the claims and the article provides it...

Stricter Rules for Voter IDs Reshape Races

By MICHAEL WINES and MANNY FERNANDEZ MAY 1, 2016

SAN ANTONIO — In a state where everything is big, the 23rd Congressional District that hugs the border with Mexico is a monster: eight and a half hours by car across a stretch of land bigger than any state east of the Mississippi. In 2014, Representative Pete Gallego logged more than 70,000 miles there in his white Chevy Tahoe, campaigning for re-election to the House — and lost by a bare 2,422 votes.

So in his bid this year to retake the seat, Mr. Gallego, a Democrat, has made a crucial adjustment to his strategy. “We’re asking people if they have a driver’s license,” he said. “We’re having those basic conversations about IDs at the front end, right at our first meeting with voters.”

Since their inception a decade ago, voter identification laws have been the focus of fierce political and social debate. Proponents, largely Republican, argue that the regulations are essential tools to combat election fraud, while critics contend that they are mainly intended to suppress turnout of Democratic-leaning constituencies like minorities and students.

More than twenty paragraphs later.

Mr. Abbott, perhaps the law’s most ardent backer, has said that voter fraud “abounds” in Texas. A review of some 120 fraud charges in Texas between 2000 and 2015, about eight cases a year, turned up instances of buying votes and setting up fake residences to vote. Critics of the law note that no more than three or four infractions would have been prevented by the voter ID law.

Nationally, fraud that could be stopped by IDs is almost nonexistent, said Lorraine C. Minnite, author of the 2010 book “The Myth of Voter Fraud.” To sway an election, she said, it would require persuading perhaps thousands of people to commit felonies by misrepresenting themselves — and do it undetected.

“It’s ludicrous,” she said. “It’s not an effective way to try to corrupt an election.”

I shouldn't have to say this but, if a story contains claims that the reporter has reason to believe are false or misleading, he or she has an obligation to address the issue promptly. Putting the relevant information above the fold is likely to anger the people who made the false statements, but doing anything else is a disservice to the readers.

Wednesday, March 24, 2021

He came to extend the light of consciousness to the stars and we accused him of having a messiah complex

I am accumulating resources to help make life multiplanetary & extend the light of consciousness to the stars

— Elon Musk (@elonmusk) March 21, 2021

And no, this does not appear to be a joke.

Tuesday, March 23, 2021

There's also a Laffer connection if you follow the links

Cathie Woods predicts Tesla will be worth 300% of the entire auto manufacturing industry within 4 years. They currently have less than 1% market share and lose money selling cars.

— Dean Sheikh (@DeanSheikh1) March 20, 2021

Implies all other car makers will file for bankruptcy.#2021Investing$TSLA

That target has inspired some skepticism.

We are also putting out our new Tesla model and price target. We think you'll find it a little bit more comprehensive and useful than the @ARKInvest model. pic.twitter.com/UOR2Vqx4R8

— ArtkoCapital (@ArtkoCapital) March 21, 2021

That 300% suggests that Tesla will have to find new worlds to conquer. The report lists insurance as a growth opportunity. If you're up for a lesson in how the insurance industry works, this long but dense thread explains why that ain't happening.

FT Alphaville makes many of the same points.I see lots of student company write-ups and pitches. Most are better than yesterday's $3,000 ARK Price Target Report for $TSLA. In reading the report its clear the motivation is to promote a higher stock price. The fantasy involved is simply spectacular... 1/

— Christopher Bloomstran (@ChrisBloomstran) March 20, 2021

Let the pump begin. pic.twitter.com/t3f2CdYHCG

— Keubiko (@Keubiko) March 22, 2021

Woods and many other analysts have done very well embracing Tesla, crypto, and all the other disruptors and their defenders invariably resort to "look at the results" arguments when critics question the projections. With that in mind, let's close with this.

it is logical that at the end of any bull market a team which has embraced the bull (and the bullshit) should be the top perfomers and appear as super heroes.

— John_Hempton (@John_Hempton) March 20, 2021

This is that team.

Monday, March 22, 2021

E.W. Niedermeyer points out an important paradox with autonomous systems -- if Tesla's FSD didn't suck so much, it would be dangerous

The last four seconds of this vid show an egregious and utterly terrifying error for a system that calls itself “Full Self-Driving” https://t.co/B5wJV3dMrU

— Faiz Siddiqui (@faizsays) March 17, 2021

Here's the entire video.

Road and Track has a painful play-by-play.

But E.W. Niedermeyer explains how a pretty good autonomous driving system would actually be more dangerous.

The fact that "Full Self-Driving" is so laughably bad is actually the main reason we haven't had crashes yet. If it improves to the point where it only makes a potentially fatal screwup every 100 miles or more, that's when people will become inattentive and over-trusting. https://t.co/dxh43iI0jX

— E.W. Niedermeyer (@Tweetermeyer) March 17, 2021

Which brings us to the main point from the panel linked above with @missy_cummings, @MikeANees and @mclamann: waiting for mediocre automation to screw up every 10, 50, 100 or 1,000 miles and then making a split-second life-and-death decision is something humans are really bad at!

— E.W. Niedermeyer (@Tweetermeyer) March 19, 2021

For an even more disturbing example, check out this from Jalopnik.

Friday, March 19, 2021

When we said drones will revolutionize the industry, we should have been more specific

Thursday, March 18, 2021

The story is "Tesla has one message for customers and investors, and another one for legal authorities." The meta-story is that the bastion of conventional wisdom is telling this story.

Did you know that Tesla is the first automaker to announce both purchase and subscription options for a product that doesn't exist?

— E.W. Niedermeyer (@Tweetermeyer) March 2, 2021

What is your preferred method of paying for things that aren't even actual things yet? #content

Part 2: These are clips from a 28-minute drive.

— Taylor Ogan (@TaylorOgan) March 16, 2021

There’s a difference between, “The software will get better when the NN has way more data,” vs. hardware ceiled Level 2 ADAS, as even Tesla now admits.

Tesla robotaxi dreamers will have to wait for cars with the proper HW. pic.twitter.com/4RBXCAcNcD

Regardless of where it's reported, this is big news (and potentially grounds for one hell of a class action lawsuit). Still, it's worth noting that highly skeptical coverage of Tesla and Musk is no longer limited to a few voices in the wilderness like Lopez of Business Insider and Hiltzik and Mitchell of the LA Times.

Tesla recently told California regulators that the "Full Self-Driving" beta software it's testing with select customers doesn't make them autonomous — nor will it any time soon.

Why it matters: The company is charging $10,000 extra for the not-really-self-driving, might-arrive-someday addition to its standard Autopilot adaptive cruise-control and lane-keeping feature.

- Meanwhile, CEO Elon Musk is selling investors on the notion that its full self-driving tech will enable Teslas to become money-generating robotaxis.

Our thought bubble: Tesla has one message for customers and investors, and another one for legal authorities.

Catch up quick: Legal transparency website PlainSite this week released a year's worth of correspondence between Tesla lawyers and the California Department of Motor Vehicles, which regulates autonomous vehicles.

- The agency had been pressing Tesla for details about the technology's evolving capability since late 2019 while reminding the company that it does not have a permit to deploy autonomous vehicles in California.