In August 2017, I jumped security and made it into the Singularity University Global Summit at the San Francisco Hilton. It was no easy task: The convention is very well staffed, and black-suited convention employees kept an eye out for convention registration badges at the doorway to every ballroom lecture hall and breakout-session dining room. The enormous badges, proudly emblazoned with the name of each attendee and that of his or her employer, were to be worn from a lanyard printed with the phrase “Be Exponential.” The absence of one around my neck was noted in glances directed at my midsection. I’d already been bounced from the expo hall once, and my ploy to acquire a press pass, recommended by a friend who’d crashed the party the year before, had failed. The Global Summit isn’t a secret, invitation-only convention. But admission is priced north of $2,000, so I couldn’t afford to be exponential. As indicated by the badges I studied as I wandered between sessions, large multinational corporations like Deloitte and Procter & Gamble send mid-level executives to the summit to do reconnaissance on technological innovations in established and emerging markets.

The steep entry fee is is part of the high-gloss veneer of selectivity favored by the organization. Most attendees believe their presence at the summit confers a special stature on their intellect and an illustrious destiny on whatever entrepreneurial endeavor has brought them there. Alumni of Singularity University receive “enhanced” clearance, which provides access to private lunches and sessions where the most elite futurists gather to discuss questions related to the future of human civilization. Attendees were overwhelmingly young, male, and poorly shaven.

I spent the afternoon in Hilton Grand Ballrooms A and B, where plenary talks were held. There I listened as innovators and “disruptors” were invited one after the next to take the stage and share with those assembled whatever TED-talk platitudes they’d rehearsed in hotel bathroom mirrors the night before. As a resident of San Francisco, I was accustomed to their techno-futurist cheerleading and unaffected by the customary flattery of libertarian entrepreneurialism steeped in Objectivist self-regard: a “small group of people,” one speaker informed the audience, was now capable of doing things that no nation-state can do. The obvious inference was that some of those people were in the building.

Comments, observations and thoughts from two bloggers on applied statistics, higher education and epidemiology. Joseph is an associate professor. Mark is a professional statistician and former math teacher.

Monday, April 8, 2019

Magical Heuristics -- the magic of destiny

You should check out this essay by Adam Morris. I'm not going to comment on his larger thesis, but his observations about Silicon Valley and VC culture are extremely interesting and nicely complement our magical heuristics thread. In case you missed our original post, check it out (particularly the part about destiny). Then see if any of Morris's observations seem to resonate.

Friday, April 5, 2019

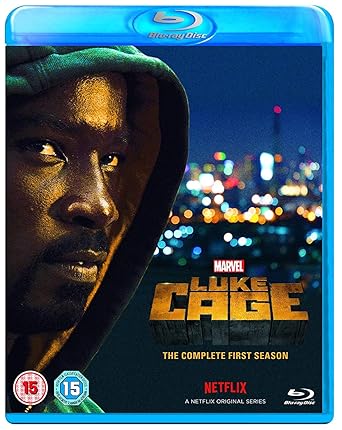

Netflix's Popcorn Problem

This segment of Rob Long's essential show business commentary Martini Shots recently addressed on of the biggest but least discussed points in the discussion of the Netflix business plan.

Most pop culture IP is based on multiple revenue stream models. Toys, syndication rights, physical media (now making something of a comeback with serious fans), and assorted licensing. Netflix appears to have limited itself to locked itself down to one revenue stream.

Keep in mind, investors who are still buying Netflix are betting that it will become the largest and most profitable media company in the world and will do so in the fairly near future, a goal that is even more difficult when you start taking money off the table.

What's more, Netflix appears to have cut deals that allow its partners to cash in on these alternate revenue streams while Netflix bears the bulk of the production and marketing costs. In a sense, it seems like the company is borrowing immense amounts of money to produce elaborate commercials for its competitors' products.

Thursday, April 4, 2019

A glimpse into the Hyperloop bullshit feedback cycle

According to this ZDNet piece by Asha McLean, the Australian government is ready to go all in on the hyperloop.

"The Hyperloop has significant advantages over competing transport modes," the committee wrote in its report [PDF] into Innovating Transport across Australia: Inquiry into automated mass transit.

"The Hyperloop would have lower capital and operating costs, smaller land requirements, and less environmental impacts than other transport modes. It also offered a more positive passenger experience."

That is an awfully deceptive framing. In the actual report, those quotes are basically summing up the HTT pitch, prefaced by "as envisaged." Furthermore, hyperloops form a fairly minor part of the report.

This is one of the best examples to date of the bullshit cycle that sustains this travesty. Credulous reporting and even more credulous investors give the companies a veneer of respectability. Politicians wanting to sound serious and forward-thinking (and possibly cash in at a later date) play along. Journalists portray even the mildest of governmental interest as an indication that hyperloops are just around the corner.

Wednesday, April 3, 2019

Some midweek tweets

"The Battle of Wakanda in Avengers: Infinity War is a master class in how not to use an infantry battalion."https://t.co/zWSzwNDi9T— Dan Lamothe (@DanLamothe) April 1, 2019

An essential readhttps://t.co/cWlh2ViiwI— Mark Palko (@MarkPalko1) March 31, 2019

Farm Automation was published on this day in 1958. #365daysofRadebaugh— Closer Than We Think (@CloserThanThink) March 30, 2019

Rent or buy the film today. https://t.co/smnp0iAX43 pic.twitter.com/FOL5YgmrWh

New chart from me: U.S. coal electricity generation continues to decline— John Muyskens (@JohnMuyskens) March 28, 2019

Read the @brady_dennis & @StevenMufson story it accompanies: ‘That’s what happens when a big plant shuts down in a small town.’ https://t.co/qZv49fPg4t pic.twitter.com/Ee7BZbzedn

Tuesday, April 2, 2019

All hyperloop/Musk transportation proposals are bad, but each is bad in its own unique way

This recent piece by Kelly Weill does a good job reviewing some of the recent set backs on the broader hyperloop front, but not such a good job distinguishing between the different technologies being proposed. This problem is by no means limited to Weill; it's endemic in the coverage of the story.

Even the name"hyperloop" applies to two radically different systems. Musk's original proposal was based on aircasters and was so bad (even by the standards of this discussion) that it was immediately dropped by every company pursuing the technology. Then came the proposal for an underground system of sleds that would carry you car around Los Angeles, and the short high speed rail lines that inspired a previous installment of our Elon Musk is a terrible engineer series.

I have a feeling one of our regular readers will have something to say about that last one.

Even the name"hyperloop" applies to two radically different systems. Musk's original proposal was based on aircasters and was so bad (even by the standards of this discussion) that it was immediately dropped by every company pursuing the technology. Then came the proposal for an underground system of sleds that would carry you car around Los Angeles, and the short high speed rail lines that inspired a previous installment of our Elon Musk is a terrible engineer series.

Elon Musk Hyperloop Dreams Slam Into Cold Hard Reality

The Hyperloop was supposed to shuttle passengers incredible distances at 700 miles per hour. The brainchild of tech visionary Elon Musk, it was proposed as a long, underground tunnel system that would propel bus-like pods of passengers at near-supersonic speeds.

Far from its promise of rocketing cities into the future, Hyperloop momentum appears to be slowing with several states and local governments that once flirted with the idea. In Virginia, the idea died after officials examined Musk’s Hyperloop test tunnel. In Chicago this month, leading mayoral candidates appeared to dismiss much-hyped plans for a Hyperloop in their city. And in Colorado, a Hyperloop company went out of business before completing a publicly funded feasibility study.

...

Arrivo came from a promising Hyperloop pedigree. Its founder, Brogan BamBrogan (his legal name), was a former engineer at Musk’s SpaceX before leaving to co-found the company Hyperloop One. After a dramatic falling out involving two feuding lawsuits, BamBrogan launched Arrivo in 2017 and started pitching Colorado hard. Hoping to reach speeds of 200 mph, the planned Arrivo Hyperloop outside Denver was a far cry from the 700 mph envisioned in Musk’s white paper. But the company’s promise to create “the end of traffic” scored them a partnership with Colorado’s Department of Transportation in November 2017, and $267,000 in publicly funded incentives, Wired reported.

The payout was meant to fund a feasibility study. But by November 2018, Arrivo had quietly furloughed all its employees, without completing the study, the Verge first reported. In mid-December, Arrivo reportedly texted or called its employees to announce the company was shutting down.

...

Meanwhile in Chicago, Hyperloop antagonism has become a talking point in an ongoing mayoral race. Current Mayor Rahm Emanuel announced preliminary plans to award Musk a contract to build a Hyperloop between downtown Chicago and the city’s O’Hare airport, a route already navigable by an elevated train line. (Unlike in Colorado, the project would not receive public subsidies.)

But the two main candidates vying to replace Emanuel have characterized the Hyperloop as a low priority project at best, and a “pay-for-play” scheme at worst. Candidate Toni Preckwinkle told the Verge that the city should focus its efforts on public transportation. Meanwhile, leading candidate Lori Lightfoot has highlighted Musk’s more than $55,000 in donations to Emanuel’s various election campaigns, suggesting those donations give the appearance of a pay-for-play relationship.

I have a feeling one of our regular readers will have something to say about that last one.

Monday, April 1, 2019

Friday, March 29, 2019

Still not even close to the most embarrassing news story to come out of Brexit

Yet another 70s nostalgia act is trying a comeback, mixing in a few topical references to try to sound current.

Of course, the fans still come for the greatest hits.

Of course, the fans still come for the greatest hits.

Thursday, March 28, 2019

Apple gives us another excuse to repost something on the content bubble

From CNET:

For example, living in LA, I frequently run into people in the entertainment industry. One of the topics that has come up a lot over the past few years is the possibility of a bubble in scripted television. Given all that we've written on related topics here at the blog, I was sure I had addressed the content bubble at some point, but I can't find any mention of the term in the archives.

One of the great pleasures of having a long running blog is the ability, from time to time, to point at a news story and say "you heard it here first." Unfortunately, in order to do that, you actually have to post the stuff you meant to. John Landgraf, the head of FX network and one of the sharpest executives in television has a very good interview on the subject of content bubbles and rather than "I told you so," all I get to say is "I wish I'd written that."

But, better late than never, here are the reasons I suspect we have a content bubble:

1. The audience for scripted entertainment is, at best, stable. It grows with the population and with overseas viewers but it shrinks as other forms of entertainment grab market share. Add to this fierce competition for ad revenue and inescapable constraints on time, and you have an extremely hard bound on potential growth.

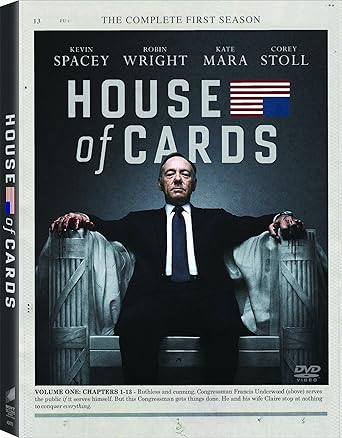

2. Content accumulates. While movies and series tend to lose value over time, they never entirely go away. Some shows sustain considerable repeat viewers. Some manage to attract new audiences. This is true across platforms. Netflix built an entire ad campaign around the fact that they have acquired rights to stream Friends. Given this constant accumulation, at some point, old content has got to start at least marginally cannibalizing the market for new content.

3. Everybody's got to have a show of their very own. (And I do mean everybody.) I suspect that this has more to do executive dick-measuring than with cost/benefit analysis but the official rationale is that viewers who want to see your show will have to watch your channel, subscribe to your service or buy your gaming system. While than can work under certain conditions, proponents usually fail to consider the lottery-ticket like odds of having a show popular enough to make it work. And yet...

4. Everybody's buying more lottery tickets. The sheer volume of scripted television being pumped out across every platform is stunning.

5. Money is no object. We are seeing unprecedented amounts of money paid for original and even second run content.

For me, spending unprecedented amounts of money to make unprecedented volume of product for a market that is largely flat is almost by definition unsustainable. Ken Levine takes a different view and I tend to give a great deal of weight to his opinions, but, as I said before, Langraf is one of the best executives out there and I think he's on to something.

Between Oprah Winfrey, Steven Spielberg, J.J. Abrams and Sofia Coppola, Apple showed off a star-studded lineup for its newly unveiled Apple TV Plus service. Consistent with the Apple way of building up its products and services, the superlatives poured forth from CEO Tim Cook.

"It's unlike anything that's been done before," he said at an event on Monday at the company's Cupertino, California, headquarters' Steve Jobs Theater.

Given the talent signed on to Apple, you might be under the impression that this is a groundbreaking, must-have service.

After all, who are we to question Oprah?

But Apple's legendary track record with products may not automatically equate to success elsewhere. For one, Hollywood is a tough business and one that Apple has little experience in. Spending an estimated $2 billion on A-list talent garners a whole lot of buzz, but it's no guarantee of success. Its first forays into original programming -- Carpool Karaoke and Planet of the Apps -- flopped.

Monday, August 31, 2015

Arguments for a content bubble

First off a quick lesson in the importance of good blogger housekeeping. It is important to keep track of what you have and have not posted . A number of times, I've caught myself starting to write something virtually identical to one of my previous posts, often with almost the same title. At the other into the spectrum, there are posts that I could've sworn I had written but of which there seems to be no trace.For example, living in LA, I frequently run into people in the entertainment industry. One of the topics that has come up a lot over the past few years is the possibility of a bubble in scripted television. Given all that we've written on related topics here at the blog, I was sure I had addressed the content bubble at some point, but I can't find any mention of the term in the archives.

One of the great pleasures of having a long running blog is the ability, from time to time, to point at a news story and say "you heard it here first." Unfortunately, in order to do that, you actually have to post the stuff you meant to. John Landgraf, the head of FX network and one of the sharpest executives in television has a very good interview on the subject of content bubbles and rather than "I told you so," all I get to say is "I wish I'd written that."

But, better late than never, here are the reasons I suspect we have a content bubble:

1. The audience for scripted entertainment is, at best, stable. It grows with the population and with overseas viewers but it shrinks as other forms of entertainment grab market share. Add to this fierce competition for ad revenue and inescapable constraints on time, and you have an extremely hard bound on potential growth.

2. Content accumulates. While movies and series tend to lose value over time, they never entirely go away. Some shows sustain considerable repeat viewers. Some manage to attract new audiences. This is true across platforms. Netflix built an entire ad campaign around the fact that they have acquired rights to stream Friends. Given this constant accumulation, at some point, old content has got to start at least marginally cannibalizing the market for new content.

3. Everybody's got to have a show of their very own. (And I do mean everybody.) I suspect that this has more to do executive dick-measuring than with cost/benefit analysis but the official rationale is that viewers who want to see your show will have to watch your channel, subscribe to your service or buy your gaming system. While than can work under certain conditions, proponents usually fail to consider the lottery-ticket like odds of having a show popular enough to make it work. And yet...

4. Everybody's buying more lottery tickets. The sheer volume of scripted television being pumped out across every platform is stunning.

5. Money is no object. We are seeing unprecedented amounts of money paid for original and even second run content.

For me, spending unprecedented amounts of money to make unprecedented volume of product for a market that is largely flat is almost by definition unsustainable. Ken Levine takes a different view and I tend to give a great deal of weight to his opinions, but, as I said before, Langraf is one of the best executives out there and I think he's on to something.

Wednesday, March 27, 2019

Also, I'm switching to Amazon Basics

This Gizmodo article on Pyrex and the pros and cons of borosilicate soda-lime glass has all of things we've come to expect from the Gawker remnants, sharp writing, solid science and genuinely helpful advice. It also fits nicely with our thread about the radical and ubiquitous technological and scientific changes of the late 19th and early 20th centuries.Nowhere was this more true than with material science, where Bessemer steel was one of the primary drivers of innovation and aluminum went from being the world's most expensive metal to the stuff of housewares. Borosilicate glass fit right in.

Pyrex made headlines recently, because its parent company made a big move. Corelle Brands, parent company of Pyrex among others, is planning to merge with Instant Brands, maker of the very popular Instant Pot. Terms of deal were not disclosed, and it’s unclear how the merger will affect any of the companies’ products. However, the news does bring to mind that decades-old controversy involving beloved glass pans, violent explosions, and some gnarly injuries. Pyrex is also the subject of a class action lawsuit in Illinois. In court filings, Pyrex’s parent company, Corelle Brands, insists that incidents of breakage result from customers improperly using their products. More on that case in a minute.

To understand the Pyrex controversy, you have to look at the reports of explosions within the context of the history of glass. Not the whole history of glass, of course, but rather a series of innovations that started with Otto Schott, a German scientist who invented a new type of glass in the late 1800s. This so-called borosilicate glass was not only heat resistant but also stood up to sudden temperature changes. Corning Glass Works developed its own recipe for borosilicate glass in 1908, and Corning employee Jesse Littleton discovered a new use for the material after his wife Bessie used a sawed-off borosilicate glass battery jar for baking. Seven years later, Pyrex cookware hit the American market. The company referred to its products as “fire-glass” in early ads.

These dates are important because Corning’s patent on the borosilicate glass used to make Pyrex pans expired in 1936. At that time, the company developed a new formula for aluminosilicate glass, which it used to create a line of frying pans called Pyrex Flameware. (This line was discontinued in 1979.) The real roots of the current controversy were planted in the 1950s, when Pyrex began making cookware out of tempered soda-lime glass. Corning licensed the Pyrex brand to a company called World Kitchen—now known as Corelle Brands—in 1998, and by nearly all accounts, all Pyrex cookware sold in the United States after that year has been made of tempered soda-lime glass. This is where the controversy really heats up.

The vast majority of glass products are made of soda-lime glass: window panes, jars, bottles, all kinds of glass. Soda-lime glass is cheaper to make than borosilicate glass, which is undoubtedly why Pyrex started experimenting with it. However, borosilicate glass is not only harder, stronger, and more durable than soda-lime glass; it’s also more resilient to thermal shock. Thermal shock is what happens when a temperature change causes different parts of a material to expand at different rates, and the resultant stress can cause the material to crack. If the temperature change happens rapidly materials like glass can shatter or seem to explode. Resistance to thermal shock is part of why Pyrex became so popular for cookware; you could move a hot glass pan into a cool spot without worrying about it cracking or shattering. It’s also part of why laboratories prefer to use borosilicate glass rather than conventional soda-lime glass. Pyrex cookware currently sold in the United States goes through a thermal tempering process. In theory, this should strengthen the glass.

In practice, the difference between the performance of borosilicate glass and soda-lime glass is significant. When asked about the science behind the glass, Dr. John C. Mauro, a professor of engineering and materials science at Penn State, said in an email that the coefficient of thermal expansion (CTE) is the main parameter used to measure thermal shock resistance. A higher CTE number means the material is less resilient to thermal shock. For example, Corning Visions cookware, a descendent of Pyrex Flameware, is designed for stovetop use and has a CTE close to zero, Mauro explained. Borosilicate glass has a CTE of 3 or 4 parts per million per 1 Kelvin change (ppm/K). But soda-lime glass has a CTE of 9 to 9.5 ppm/K.

Tuesday, March 26, 2019

"State to begin study of hyperloop technology, potential Pittsburgh-to-Philadelphia route "

More anecdotal evidence that the hyperloop hype is growing both more dangerous and detached from reality.

This also illustrates a couple of essential points in the narrative. We have gone beyond the level of mere distraction; real money is now being diverted from already underfunded projects.

Second, as with Mars One, point is that the proposal is based on long existing tech is seen as an argument for rather than against feasibility. You very seldom see obvious applications sitting unutilized for decades and suddenly becoming viable for no reason. Major advances are almost always due to a breakthrough in enabling technology (think internal combustion or transistors) or a big shift in the underlying economics. Neither appears to be the case here.

From the Post Gazette:

This also illustrates a couple of essential points in the narrative. We have gone beyond the level of mere distraction; real money is now being diverted from already underfunded projects.

Second, as with Mars One, point is that the proposal is based on long existing tech is seen as an argument for rather than against feasibility. You very seldom see obvious applications sitting unutilized for decades and suddenly becoming viable for no reason. Major advances are almost always due to a breakthrough in enabling technology (think internal combustion or transistors) or a big shift in the underlying economics. Neither appears to be the case here.

From the Post Gazette:

The Pennsylvania Turnpike Commission this week approved a four-year contract worth up to $2 million for consultant AECOM to review the potential for a hyperloop system that would extend across the state. The turnpike and the state Department of Transportation, which is part of the advisory group working with the consultant, were ordered to do such a study in a resolution approved last fall by the state House.For a bit of context:

Hyperloop is a system that developers say can transport passengers and freight at more than 500 mph in pods that move through low-pressure tubes similar to pneumatic tubes at banks. [No, it’s not. These systems have almost nothing in common. Please stop saying that. – MP] The Mid-Ohio Regional Planning Commission is working with one developer, Virgin Hyperloop One, to study and establish a system linking Pittsburgh, Columbus and Chicago, but other companies also are developing the technology.

It is important for the state to stay abreast of new transportation modes, Robert Taylor, the turnpike’s chief technology officer, said Friday.

“This is a technology that can change us as a state, change us as a region,” Mr. Taylor said.

Barry Altman, a communication specialist in the turnpike’s information technology division, said the study will determine whether the use of hyperloop technology will help or hurt the turnpike’s operation.

“Our interest in it is to take a look at it to see how we can use it to grow our business and what threat it presents to our business,” he said. “We don’t see it as a technology that will supersede our business. We’re looking at it interfacing with what we do.”

…

State Rep. Aaron Kaufer, R-Luzerne County, proposed the resolution for the study to be completed by April 2020. He couldn’t be reached for comment Friday. The resolution said the state has an opportunity to benefit from hyperloop technology “by leveraging corporate and institutional talent and resources to participate in the research and development of the technology, and the supply chain needed to produce and construct hyperloop corridors.”

There are no commercial hyperloop systems in operation now, but Virgin Hyperloop has a test facility in the Mojave Desert outside Las Vegas. The company expects the first system to open sometime in the next decade, likely in India or Dubai, where there is more vacant land and funding.

Mr. Altman said he’s convinced the technology is viable while Mr. Taylor said he’s a “cynic” but is more concerned about issues such as regulatory policies and financing than whether the technology will work.

“I think it’s solid technology,” Mr. Altman said. “They are taking existing technology from a number of areas and assembling it in a system that’s going to be very workable.”

In this region, AECOM already is working with the Mid-Ohio planners on a feasibility study of the proposed Pittsburgh-Columbus-Chicago corridor, where travel time would be about 48 minutes from one end to the other. Another consultant is doing a preliminary environmental impact study, and both should be finished this summer.

HARRISBURG, Pa. (AP) — Pennsylvania’s elected fiscal watchdog is urging state lawmakers to rescue a Pennsylvania Turnpike Commission that is deep in debt from payments it must make to the state, despite annual toll increases going back 11 straight years.

Auditor General Eugene DePasquale said Thursday that the annual toll increases are driving toll-paying truckers and motorists away, but the extra toll revenue is not reducing the commission’s rising debt.

Monday, March 25, 2019

“It’s a car in a very small tunnel”

Via Aaron Gordon of Jalopnik.

Late last year we commented on the strangely positive reaction of Chicago delegation to the underwhelming debut of the Boring Company's first project. It is with considerable relief (and more than a touch of amusement) that not all of the transit officials who came by helped themselves to the Flavor-aid.

This Virginia Mercury report by Ned Oliver is a study in brutal understatement. [emphasis added]

Late last year we commented on the strangely positive reaction of Chicago delegation to the underwhelming debut of the Boring Company's first project. It is with considerable relief (and more than a touch of amusement) that not all of the transit officials who came by helped themselves to the Flavor-aid.

This Virginia Mercury report by Ned Oliver is a study in brutal understatement. [emphasis added]

“It’s a car in a very small tunnel,” Michael McLaughlin, Virginia’s chief of rail transportation, told members of the Commonwealth Transportation Board’s public transit subcommittee on Wednesday.

“If one day we decide it’s feasible, we’ll obviously come back to you.”

The board has been discussing high-dollar investments in the state’s rail infrastructure, including a $1.3 billion bridge between Virginia and Washington. But board members say those conversations have been clouded by questions about whether such upgrades might be rendered obsolete before they’re even completed if Musk’s much-hyped tunneling and hyperloop technology advances beyond its current experimental stage. [And remember, these are the non-gullible ones. -- MP]

…

At this stage, all Musk has to show for his work is a Tesla Model 3 running on guard rails through a bumpy, 1.14-mile long demonstration tunnel under an industrial park in Hawthorne, California. (Musk said employees ran out of time to smooth the road bed, and the Los Angeles Times reports it was “so uneven in places that it felt like riding on a dirt road.”)

Tunneling isn’t a new technology. The innovation Musk hopes to bring to it is a drastic reduction in costs. And on that front, he claims he’s been successful, saying the project cost about $10 million. That’s significantly less than the $170 million to $920 million per mile cost of recent subway projects around the country, according to CityLab, which notes Musk’s figure doesn’t include research, development, equipment and, possibly, labor.

The officials from Virginia who met with company leaders and took a drive through the tunnel in January say nothing they saw would lead them to change their approach to transit in the near term.

“I think there’s a lot of show going on here,” said Scott Kasprowicz, a Commonwealth Transportation Board member who made the trip with McLaughlin and public transit chief Jennifer Mitchell.

“I don’t mean to suggest that they don’t have a serious plan in mind, but I don’t consider the steps they’ve taken to date to be substantive. They’ve purchased a used boring machine. They’ve put a bore in the neighborhood where they developed the SpaceX product, and they’ve taken a Model 3 and put guidewheels on it and they’re running it through the tunnel at 60 miles per hour.

Friday, March 22, 2019

An excuse to repost one of the few times probability, classic TV and horse racing collide

Annual reminder. Bragging about how well your “bracket” is doing when in fact you filled out multiple *brackets* makes you history’s greatest monster.— John Gasaway (@JohnGasaway) March 21, 2019

It is with profoundly mixed emotions (though surprise is not among) that I have to admit that Matt Novak got here first in his indispensable Paleo-Future.

Thursday, March 21, 2019

Some stories I'm keeping an eye on

How SHOULD campaign coverage be distributed among candidates for an open nomination 300 days or so from the first voting? @sulliview asks herself that in her latest column. Her answer: "That depends on what the coverage aim is."— Jay Rosen (@jayrosen_nyu) March 20, 2019

Read why it depends: https://t.co/0UneiFEZya

Lukewarm take: the conventional wisdom is right that Biden, Bernie, Harris, Beto are the 4 candidates most likely to win the Democratic nomination in some order. https://t.co/VogcZrTbsf— Nate Silver (@NateSilver538) March 19, 2019

So much for the alleged evidence that institutional investors were getting interested in crypto. There was almost no trading in those Bitcoin futures. Crypto is a dying "asset" class.— Nouriel Roubini (@Nouriel) March 17, 2019

Cboe Discontinues Bitcoin Futures for Nowhttps://t.co/NwFp5Rf8QD

A recent @accenture advertisement appeared on my timeline as a promoted tweet and got me thinking about the evolution of bullshit.— Calling Bullshit (@callin_bull) March 13, 2019

The text is a perfect example of what we call *old-school bullshit*. It's a vapid jumble of jargon, neologism, and manager-speak. 1/n pic.twitter.com/0qUUUON0Dt

Wednesday, March 20, 2019

SpaceX is betting on technological stagnation

This isn't exactly a new thought, but I don't think I've ever consciously framed it in just these words before. As we've observed before, SpaceX is making real and important advances, but it is incremental progress built on technology that is, at its core, over a half century old.

Not only was SpaceX never really the disruptor it was billed as; its position depends on no real disruptor entering the industry. Now it may be facing two, and if both should come through, it is not entirely clear how much of a niche would be left between them.

It is difficult to know for certain how much progress those Russian engineers are making on nuclear rockets, work on a workable spaceplane seems to be moving along at a nice pace.

Not only was SpaceX never really the disruptor it was billed as; its position depends on no real disruptor entering the industry. Now it may be facing two, and if both should come through, it is not entirely clear how much of a niche would be left between them.

It is difficult to know for certain how much progress those Russian engineers are making on nuclear rockets, work on a workable spaceplane seems to be moving along at a nice pace.

Not only would Sabre power units enable rapid, point-to-point transport inside the atmosphere, but they would also allow reusable vehicles to make the jump straight to orbit without the need for multiple propellant stages - as is the case now with conventional rockets.

Sabre would work like an air-breathing jet engine from standstill to about Mach 5.5 (5.5 times the speed of sound) and then transition to a rocket mode at high altitude, going at 25 times the speed of sound to get into space, if this is the chosen destination.

...

The essential innovations include a compact pre-cooler heat-exchanger that can take an incoming airstream in the region of 1,000C and cool it to -150C in less than 1/100th of a second.

REL proved the pre-cooler's efficiency at taking an ambient air stream to low temperature in 2012. Now it must do the same in a very high-temperature regime. This is the purpose of the Colorado tests.

"To have a very high-temperature, high-volume flow of air to test the pre-cooler - we needed a new facility. That is now complete," explains Shaun Driscoll, REL's programmes director

"We will be running tests in the next month or two. We will be using re-heated aero engines to drive air through the system. We will drive air into the pre-cooler at up to 1,000C."

...

REL is a private venture with the backing of aerospace giants BAE Systems, Rolls-Royce and Boeing. It has also received significant R&D support from the UK government. Esa's propulsion specialists act as technical auditors, assessing each step in the development of the Sabre concept.

Tuesday, March 19, 2019

"Significant negative indicator" is a beautiful piece of understatement

Threads like this by Jawad Mian are one of the best reasons to stick with Twitter.

Lots more good stuff. Give it a read.

5) VCs raising ever-larger funds at an increasing pace, despite a lack of viable opportunities. Sequoia raised $8bn, largest ever by US venture firm. “It’s easier to raise money than anytime I’ve been in the business," said David Rubenstein. Does not bode well for future returns.

6) Gulf money is notoriously late to the party, purchasing Carlye Group in 2007 at the peak of the credit bubble, and anchor investors in Glencore IPO in 2011 at the peak of the commodity bubble. Now they are "all in" on Uber and opened offices in Silicon Valley to do more.

7) Discipline is loosening considerably. @bfeld noted, "A number of companies, often times with nothing more than a team and a Powerpoint presentation, have had great success raising capital north of that $10 million level... I view this as a significant negative indicator."

...

10) After the new SEC chairman, Jay Clayton, “pledged” to look after ordinary investors upon taking the job, he said he wants to make it easier for small mom-and-pop investors to invest in private companies.

...

14) Uber's new CEO said, "We suffer from having too much opportunity right now as a company." Uber addresses this ailment by burning money some $20 billion since it’s founding a decade ago and now accessing public markets as private capital is tapped out.

15) A century ago, railroad entrepreneurs found a ready market to fund their massive expansion plans based on an extreme overestimation of the market opportunity. This ended badly, of course, and holds more parallels to today’s ride-sharing companies than we might like.

16) On seeing the announcement of a new issue of stock by the Northern Pacific and Great Northern roads, Jesse Livermore said, “The time to sell is right now... If money already was that scarce and the railroads needed it desperately. What was the answer? Sell ’em! Of course!"

Lots more good stuff. Give it a read.

Subscribe to:

Posts (Atom)