Comments, observations and thoughts from two bloggers on applied statistics, higher education and epidemiology. Joseph is an associate professor. Mark is a professional statistician and former math teacher.

Wednesday, September 7, 2011

"Ask Mister Math Person"

When a toothache is fatal

A commenter says that according to local news reports, he was quoted a price of $27 for the antibiotic (sounds like erythromycin, then), and $3 for a painkiller. I believe the former, but I have a very hard time swallowing the latter. I mean, I guess I could be wrong, but I am very skeptical that there is a pharmacy out there that sells more than a dose or two of any prescription painkiller for $3. If he chose to take two vicodin over antibiotics, when he must have known that this was not a long-term solution, I have to question his decision-making even more deeply.

But what this illustrates is just how hard it is to make a decision when in extreme levels of pain. I believe the legal term is "diminished capacity". Now, this sort of tragedy can happen under nationalized health care too. But imagine what happens if this type of decision making is extended to emergency rooms?

When good news is a long way away

These long-held concerns are now critical in a decade where the 79 million U.S. people born between 1946 and 1964 start retiring as soon as this year and larger boomer retirement waves build to peak around 2020-2022.

The concern is that the ebb and flow of U.S. stock markets over the past 50 years is highly correlated with the available pool of household savings channeled into equity investment.

Assuming peoples' prime savings years are those between ages 40 and 65, the proportion of the population in that bracket is therefore key to driving the market. As early as the 1980s, economists feared the impact this may have on U.S. housing markets -- and the recent real estate bust may owe it something -- but stock market connections are more convincing.

The data is alarming. Movements in the ratio of these high savers to both retirees and younger adults has presaged long cycles in real equity prices from the downward funk of 1970s to the subsequent 18-year equity boom through the late 1980s and 1990s as boomers swelled the ranks of prime savers.

The worrying bit for the United States is that ratio peaked in 2010.

This may very well be the beginning of the long and painful adjustment suggested in Boom, Bust and Echo. On the academic side, I expect these types of weakening returns to slow retirements, especially as Universities shift more and more to defined contribution pension plans., Mark's excellent post on this makes it rather obvious how unimportant returns are to wealth when they are as low as they are now.

The question is how do we break out of this cycle?

Alternatively, what is the best strategy for those of us who have to try and make some sort of plan for the future under these conditions?

And, finally, with bond yields low and the cost of Social Security baked into the financial system, why is this a good time to talk about privatizing the system? Wouldn't we want to do this in an environment with high rates of return on assets to make the new program have a chance to succeed?

Monday, September 5, 2011

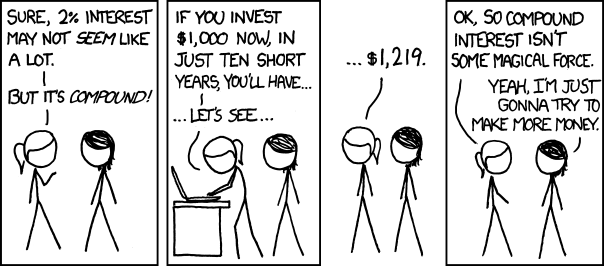

XKCD on investing

Sunday, September 4, 2011

Cassandra in reverse?

Think about it (no time for full links); by reading that section you could have learned, either from the editorial page proper or from the paper’s favorite op-ed guys, that

Clinton’s tax hike would cause a recession and send stocks plunging

Dow 36,000!

American households are saving plenty thanks to capital gains on their houses

Interest rates will soar thanks to Obama’s deficits

And much, much more.

What’s remarkable is that the Journal does not seem to pay a price for this record of awesome wrongness. Maybe subscribers buy the paper for the reporting (although if you ask me, that’s been going downhill since the Murdoch takeover). But as far as I can tell, lots of people still take the editorial page’s pronouncements seriously, even though it seems likely that you could have made a lot of money by betting against whatever that page predicts.

That really does point to an oddity in human culture. Being wrong does not seem to impact on the authority of the source, at least in some groups. That is an unfortunate property as incorrect predictions should make us rethink our internal models rather than reinforce them.

There are complexities here (everyone will have at least some sort of hit rate as even bad predictions are right every once in a while). But it does seem odd that we often double down on bad ideas.

Friday, September 2, 2011

Because it isn't there

I seem to vaguely recall a time when Americans dreamed up big, ambitious projects.

From NPR's The World:

Dubbeling also insists that the Dutch need a new big engineering project.

“Since we stopped reclaiming land from the sea, we Dutch are in some kind of identity crisis. And in the last decades we could export our ideas. But now, with this economic crisis, we really have to think of something different. ”

A mountain, Dubbeling says, definitely qualifies on that score.

Thursday, September 1, 2011

Credentialing versus teaching

Learning is cheaper and easier than ever. And yet getting a degree is more expensive. How’s that? Something’s off, in a big way. Now of course you can push this too far: “Does Yglesias think we don’t need colleges because people can just look things up on Wikipedia instead?” No, I don’t. But I do remember hearing a lot of bluster from old-line media outlets once upon a time that proved to be completely wrong.

I think that the argument about ease of information transfer is right on. That is why a lot of the argument about higher education have settled into "credentialing" and "signaling". Neither of these functions is easier in the internet age and, to some extent, they may be harder (due to more noise and less signal). That makes it very valuable for universities to be able to do these functions.

The problem, as I see it, is that both tasks can be separated from objective outcomes. If you take a program to learn something then that is a concrete and testable outcome. If you take a program to get a credential, then it is quite possible to divorces this from skills or learning (see mail order college degrees).

That is the function that it gets easy to dilute and that could be a very big deal at some point.

Student Debt

The schools sometimes push these students into high-cost private loans that they can never hope to repay, even when they are eligible for affordable federal loans. Because the private loans have fewer consumer accommodations like hardship deferments, the borrowers often have little choice but to default.

Worse yet, these loans and the bad credit history follow the debtors for the rest of their lives. Even filing for bankruptcy doesn’t clean the slate.

I think the experiment with undischargeable debt has been tried many times over history and it never really ends well. Financing higher education is always going to be tricky (due to the large sums involved and the fact that students do not have a credit history). It also doesn't help that students lack assets so it can be an economically rational decision to accept an early career bankruptcy to discharge a six figure debt.

But the opposite extreme is looking increasingly like a bad idea.

Wednesday, August 31, 2011

Economics puzzle

We researched the 100 U.S. corporations that shelled out the most last year in CEO compensation. At 25 of these corporate giants, we found, the bill for chief executive compensation actually ran higher than the company's entire federal corporate income tax bill.

Accounting games like "transfer pricing" have sent the corporate share of federal revenues plummeting. In 1945, U.S. corporate income taxes added up to 35 percent of all federal government revenue. This year, corporate income taxes will make up just 9 percent of federal receipts. In 1952, the year Republican President Dwight Eisenhower was elected, the effective income tax rate for corporations was 52.8 percent. Last year it was just 10.5 percent.

Among the nation's top firms, the S&P 500, CEO pay last year averaged $10,762,304, up 27.8 percent over 2009. Average worker pay in 2010? That finished up at $33,121, up just 3.3 percent over the year before.

The last is especially puzzling. When salaries rise faster for a specific category of jobs, it tends to signal that the market is finding a shortage of qualified people. It's also the golden time of opportunity for outsiders to break into the market and drop wages.

Or, option B, it is a feature of rent seeking due to a protected market. Which one strikes out humble reader as more likely?

Tuesday, August 30, 2011

A different point of view on Michael Lewis

My favorite part:

Yet, Germany is a prosperous and pleasant nation to live in; one of the best in the world. Germany manages to have lower unemployment than the US, despite all their unions and socialistic regulations for hiring and firing: laws which Harvard economist ding a lings will insist would be the ruination of the American economy. How did the Germans manage this?

The stuff on Iceland is first rate as well. Definitely worth the read.

Saturday, August 27, 2011

More Freakonomics causality

Since the introduction of the ultrasound in Asia, in the early 1980s, it's often been used to determine the gender of a fetus -- and, if it's female -- have an abortion. In a part of the world with big populations, these sex selection abortions have had a big, unintended consequence.The hypothesis that increasing the ratio of men to women would produce "more sex-trafficking, more AIDS, and a higher crime rate" is entirely reasonable, but like so much observational data there's a big self-selection factor here. Families and women not involved in the sex trade tend to avoid rough neighborhoods and red light districts. There's also a question about outliers -- a few very bad areas with very high male to female ratios.Hvistendahl: I mean there are over 160 million females missing from the population in Asia, and to put that in perspective, it's more than the entire female population of the United States.

So, what happens in a world with too many men? For starters, there's more sex-trafficking, more AIDS, and a higher crime rate. In fact, if you want to know the crime rate in a given part of India, one surefire indicator is the gender ratio. The more men, the more crime. Now, the ultrasound machine didn't create these problems, but it did enable them. So, you have to wonder. What's next?

Once again, the suggestion that changing gender ratios would have significant social consequences makes perfect sense, but if you want to go from sensible suggestion to well-supported hypothesis, it's not enough to mention a fact that points in the right direction; you also have to show how other explanations (self-selection, sampling bias, etc.) can't explain away your fact. That, unfortunately, is where Freakonomics and many other economists-explain-the-world books and articles fail to make the grade.

"Picked so green you could kick them to market"

At the time my grandfather was engaging in a bit of comic hyperbole. These days he might be understating the case (Barry Estabrook, author of Tomatoland, from an NPR interview):

Yeah, it was in southwestern Florida a few years ago, and I was minding my own business, cruising along, and I saw this open-back truck, and it looked like it was loaded, as you said, with green apples.And then I thought to myself wait, wait, apples don't grow in Florida. And as I pulled up behind it, I saw they were tomatoes, a whole truckload mounded over with perfectly green tomatoes, not a shade of pink or red in sight. As we were going along, we came to a construction site, the truck hit a bump, and three or four of these things flew off the truck.

They narrowly missed my windshield, but they did hit the pavement. They bounced a few times, and then they rolled onto the shoulder. None of them splattered. None of them even showed cracks. I mean, a modern-day industrial tomato has no problem with falling off a truck at 60 miles an hour on an interstate highway.

In addition to being tasteless, Estabrook also points out that compared to tomatoes from other sources or from a few decades ago, the modern Florida variety have fewer nutrients, more pesticides (particularly compared to those from California), and are picked with what has been described as 'slave labor' (and given the use of shackles this doesn't seem like much of an exaggeration).

Thursday, August 25, 2011

As problems go, that one really is pretty fundamental

“Groupon’s fundamental problem is that it has not yet discovered a viable business model,” writes Harvard Business School’s Rob Wheeler. “The company asserts that it will be profitable once it reaches scale but there is little reason to believe this.”

More from Salmon on Dalberg

(while you're there, make sure to check out his take-down of Steve Brill.)

From the New Republic. Seriously.

Rick Perry Is a Higher-Education Visionary. Seriously.

I'm way too busy to give this the attention it doesn't deserve but I thought it was a data point worth noting.

Update: Dean Dad (who's generally much more impressed with Kevin Carey than I am) isn't very impressed by Carey's case.

The larger flaw in Carey’s analysis, though, is that it mistakes saying for doing. If Governor Perry really wanted to remake Texas’ higher education system into something more teaching-focused and less research-focused -- a debatable goal, but not an absurd one -- I’d expect to see him beef up the teaching-focusd institutions that already exist. If he shifted state funding from, say, Texas A&M to the state and community colleges, then yes, I could start to buy the argument that he actually means it. If he decided that other parts of the country have the whole “research” thing well in hand, and he wanted to focus Texas on teaching, I’d expect to see him divert money from UT-Austin and send it to the K-12 districts and the community colleges. One could argue the wisdom of that, but at least it would be a vision.

No. He’s endorsing an attack on universities for not being high schools, an attack on community colleges for being high schools, and an attack on K-12 for, well, being there. Yes, some isolated bits of rhetoric could make sense in another context, but that’s not what’s happening. I agree with Carey on the oft-noted paradox that academics who are otherwise liberal become dogmatically, idiotically conservative when discussing their own profession, but their skepticism about Perry is fairer than that. Some of Perry’s rhetoric may be interesting, but at the end of the day, his only vision for higher education is hostility.